See coverage of our conference here

See coverage of our conference here

Tag: law as finance

Draft Agenda for the 2017 Fin (Legal) Tech Conference is Now Live

The Draft Agenda for the 2017 Fin (Legal) Tech Conference is Now Live –One Stage, No Panels, 20+ Speakers in 1 Day with More Speakers to Be Announced Soon. Sign up for a FREE Ticket Today — See you on October 19, 2017 in Chicago!

Law on the Market? Abnormal Stock Returns and Supreme Court Decision-Making (Version 2.01 on arXiv)

Here is Version 2.01 of the Law on the Market Paper —

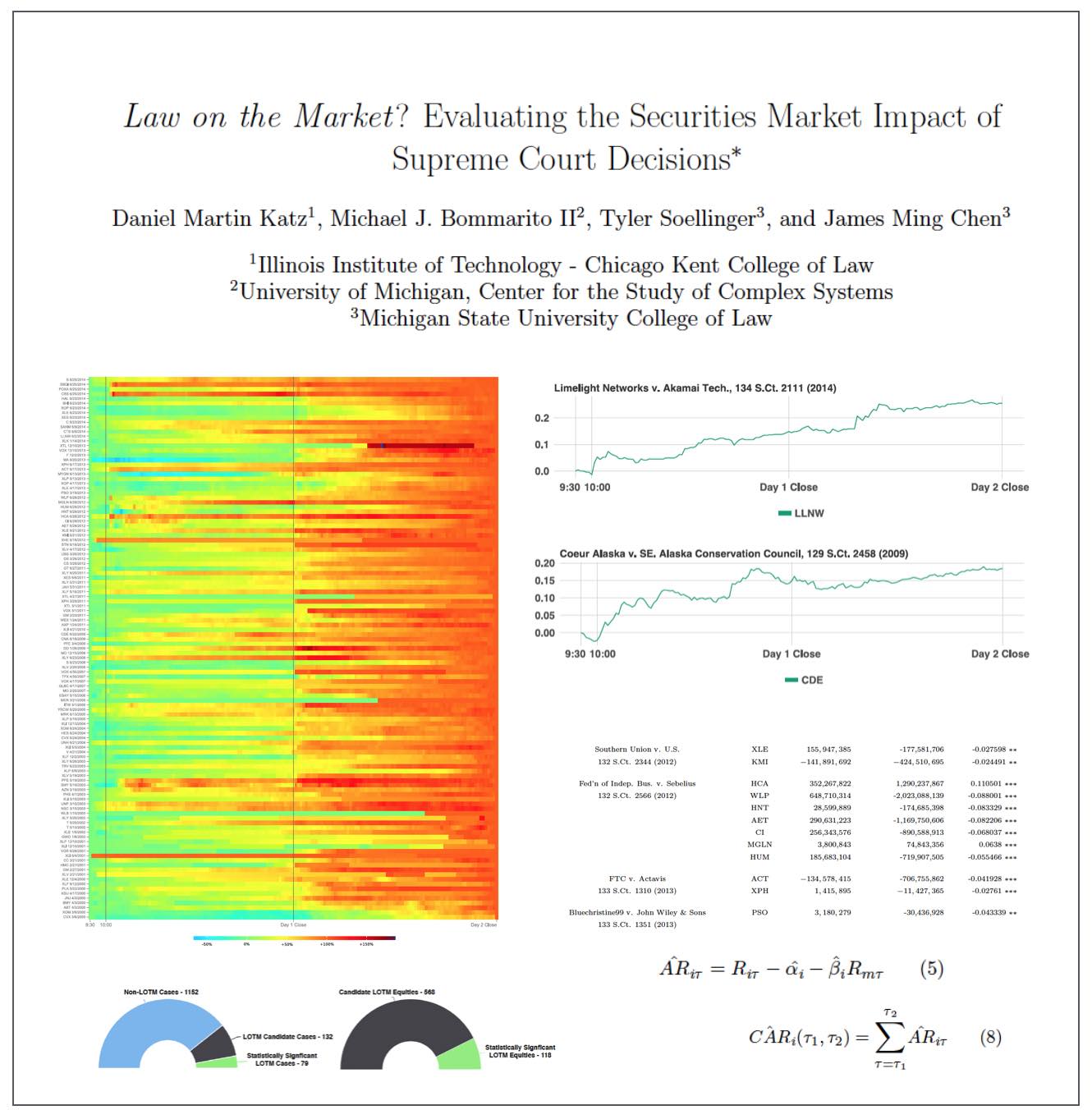

From the Abstract: What happens when the Supreme Court of the United States decides a case impacting one or more publicly-traded firms? While many have observed anecdotal evidence linking decisions or oral arguments to abnormal stock returns, few have rigorously or systematically investigated the behavior of equities around Supreme Court actions. In this research, we present the first comprehensive, longitudinal study on the topic, spanning over 15 years and hundreds of cases and firms. Using both intra- and interday data around decisions and oral arguments, we evaluate the frequency and magnitude of statistically-significant abnormal return events after Supreme Court action. On a per-term basis, we find 5.3 cases and 7.8 stocks that exhibit abnormal returns after decision. In total, across the cases we examined, we find 79 out of the 211 cases (37%) exhibit an average abnormal return of 4.4% over a two-session window with an average |t|-statistic of 2.9. Finally, we observe that abnormal returns following Supreme Court decisions materialize over the span of hours and days, not minutes, yielding strong implications for market efficiency in this context. While we cannot causally separate substantive legal impact from mere revision of beliefs, we do find strong evidence that there is indeed a “law on the market” effect as measured by the frequency of abnormal return events, and that these abnormal returns are not immediately incorporated into prices.

Announcing The Fin (Legal) Tech Conference – @ Illinois Tech – Chicago Kent College of Law November 4, 2016 (Sign up Today for a Free Ticket)

#FinTech embraces two major themes – characterizing / pricing increasingly exotic forms of risk and removing unnecessary frictions from friction laden financial processes. #Fin(Legal)Tech is the application of those ideas and technology to a wide range of law related spheres including litigation, transactional work and compliance.

The Law Lab at Illinois Tech – Chicago-Kent College of Law presents its first #Fin(Legal)Tech Conference on November 4, 2016. Continuing its legacy as an academic leader in legal technology and innovation, Chicago-Kent College of Law will bring together a wide-ranging and diverse group of industry leaders for a truly unique conference experience.

Attendees will be able to see rapid-fire and deeply engaging presentations on the following subjects:

Legal Risk, Legal Underwriting & Legal Insurance

Blockchain and Computable Contracts

MicroLaw / Long Tail Legal Markets

New Legal Information Infrastructure

Quantitative Legal Prediction & Legal Analytics

The Frictionless Delivery of Legal Services

Artificial Intelligence and Law

We will be soon announcing the speaker list but tickets are now open so if you want to attend please register for a FREE ticket today!

Law Firm COO & CFO Forum Pre-Conference Workshop on Big Data / Legal Analytics / Legal Informatics

Yesterday I had the pleasure of participating in the Thomson Reuters Law Firm COO & CFO Forum Pre-Conference Workshop on Big Data. The half day workshop explored various way that law firms and outside counsel can use data to be better lawyers and run better businesses.

Yesterday I had the pleasure of participating in the Thomson Reuters Law Firm COO & CFO Forum Pre-Conference Workshop on Big Data. The half day workshop explored various way that law firms and outside counsel can use data to be better lawyers and run better businesses.

Here is the information for my panel (below) and the full program is located here.

Few business trends are as simultaneously revered, derided, appreciated or ignored as that of big data. Used (somewhat flippantly) to describe large, complex data sets that resist traditional data processing applications, big data represents both a beginning and end for many professional industries ill- prepared to harness big data’s myriad benefits and value. This opening conversation lays the framework for our program by addressing four key questions and concerns:

- What is big data?

- Why should we use it?

- Where does it lie within a business organization?

- How do we identify ROI and value in big data investment?

Moderator:

John Fernandez – US Chief Innovation Officer and Partner Dentons; Global Chair, NextLaw Labs

Panelists:

Justin Ergler – Director, Alternative Fee Intelligence and Analytics, GlaxoSmithKline

Daniel Martin Katz – Associate Professor of Law, Illinois Institute of Technology Chicago-Kent College of Law; Chief Strategy Officer, LexPredict

Michael S. Klastava – Vice President, Global Head of Legal Data & Analytics, American International Group, Inc.

Christopher Zorn – Liberal Arts Research Professor of Political Science and Sociology, The Pennsylvania State University; Principal, Quantitative Analysis, Lawyer Metrics

Law on the Market? Evaluating the Securities Market Impact Of Supreme Court Decisions (Katz, Bommarito, Soellinger & Chen)

ABSTRACT: Do judicial decisions affect the securities markets in discernible and perhaps predictable ways? In other words, is there “law on the market” (LOTM)? This is a question that has been raised by commentators, but answered by very few in a systematic and financially rigorous manner. Using intraday data and a multiday event window, this large scale event study seeks to determine the existence, frequency and magnitude of equity market impacts flowing from Supreme Court decisions.

We demonstrate that, while certainly not present in every case, “law on the market” events are fairly common. Across all cases decided by the Supreme Court of the United States between the 1999-2013 terms, we identify 79 cases where the share price of one or more publicly traded company moved in direct response to a Supreme Court decision. In the aggregate, over fifteen years, Supreme Court decisions were responsible for more than 140 billion dollars in absolute changes in wealth. Our analysis not only contributes to our understanding of the political economy of judicial decision making, but also links to the broader set of research exploring the performance in financial markets using event study methods.

We conclude by exploring the informational efficiency of law as a market by highlighting the speed at which information from Supreme Court decisions is assimilated by the market. Relatively speaking, LOTM events have historically exhibited slow rates of information incorporation for affected securities. This implies a market ripe for arbitrage where an event-based trading strategy could be successful.

Available on SSRN and arXiv