Lots has happened in the past three years in the Law ∩ Finance space … but here is my 2017 talk that I gave at Bucerius Law School.

Tag: fin legal tech

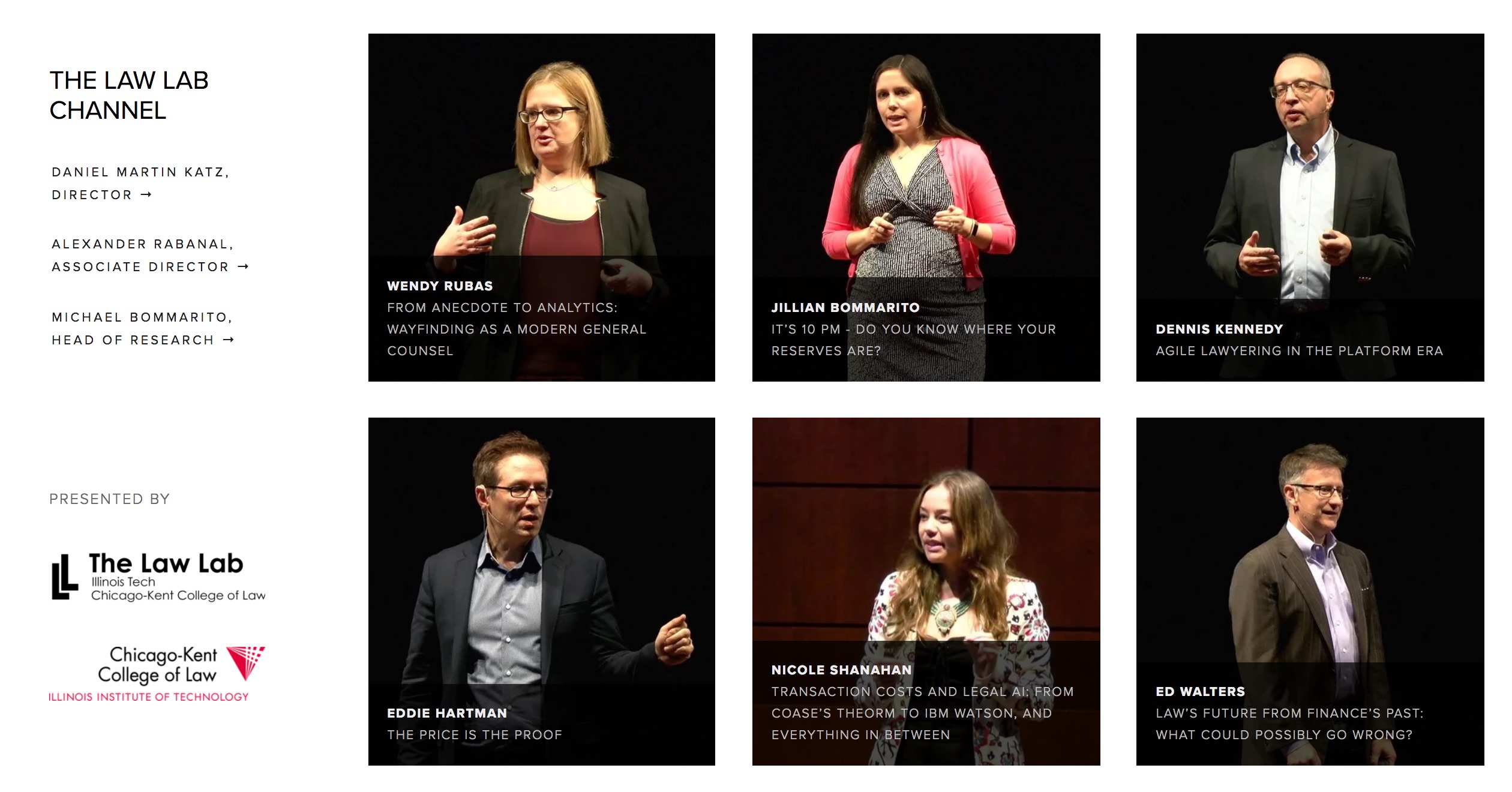

Six New Videos Added to TheLawLabChannel.com

WENDY RUBAS (VILLAGEMD)

FROM ANECDOTE TO ANALYTICS: WAYFINDING AS A MODERN GENERAL COUNSEL

JILLIAN BOMMARITO (LEXPREDICT)

IT’S 10 PM – DO YOU KNOW WHERE YOUR LEGAL RESERVES ARE?

DENNIS KENNEDY (MASTERCARD)

AGILE LAWYERING IN THE PLATFORM ERA

EDDIE HARTMAN (LEGALZOOM)

THE PRICE IS THE PROOF

NICOLE SHANAHAN (STANFORD CODEX)

TRANSACTION COSTS AND LEGAL AI: FROM COASE’S THEOREM TO IBM WATSON, AND EVERYTHING IN BETWEEN

ED WALTERS (FASTCASE)

LAW’S FUTURE FROM FINANCE’S PAST: WHAT COULD POSSIBLY GO WRONG?

Draft Agenda for the 2017 Fin (Legal) Tech Conference is Now Live

The Draft Agenda for the 2017 Fin (Legal) Tech Conference is Now Live –One Stage, No Panels, 20+ Speakers in 1 Day with More Speakers to Be Announced Soon. Sign up for a FREE Ticket Today — See you on October 19, 2017 in Chicago!

The 2017 Fin Legal Tech Conference @ Illinois Tech – Chicago Kent College of Law (Sign Up for a Free Ticket Today)

The Law Lab at Illinois Tech – Chicago-Kent College of Law presents its second Fin(Legal)Tech Conference on October 19, 2017. Continuing its legacy as an academic leader in legal technology and innovation, Chicago-Kent will bring together a wide-ranging group of industry leaders for a truly unique conference experience. Attendance is FREE but registration is required! Sign up for a FREE Ticket Today.

Thanks to Chapman and Cutler for helping sponsor the event!

The 2017 Financial Times (FT) Innovative Lawyers Summit – London

It was my great pleasure to speak at the FT Innovative Lawyers Summit here in London !

Digital Coins Are So Hot, Startups Are Selling Them Like an IPO (via Bloomberg)

ICO vs IPO … ICO’s are So Hot – “ICOs may seem to fall into a legal gray area, but she says the vast majority of tokens count as securities, and if they are sold to investors in the U.S., they fall under the jurisdiction of the Securities and Exchange Commission … The SEC has yet to wade in, but the hotter the ICO market, the greater the potential for abuse or investor losses that could spur the agency to act. Channing suspects the regulators are waiting for the right case.”

Law on the Market? Abnormal Stock Returns and Supreme Court Decision-Making (Version 2.01 on arXiv)

Here is Version 2.01 of the Law on the Market Paper —

From the Abstract: What happens when the Supreme Court of the United States decides a case impacting one or more publicly-traded firms? While many have observed anecdotal evidence linking decisions or oral arguments to abnormal stock returns, few have rigorously or systematically investigated the behavior of equities around Supreme Court actions. In this research, we present the first comprehensive, longitudinal study on the topic, spanning over 15 years and hundreds of cases and firms. Using both intra- and interday data around decisions and oral arguments, we evaluate the frequency and magnitude of statistically-significant abnormal return events after Supreme Court action. On a per-term basis, we find 5.3 cases and 7.8 stocks that exhibit abnormal returns after decision. In total, across the cases we examined, we find 79 out of the 211 cases (37%) exhibit an average abnormal return of 4.4% over a two-session window with an average |t|-statistic of 2.9. Finally, we observe that abnormal returns following Supreme Court decisions materialize over the span of hours and days, not minutes, yielding strong implications for market efficiency in this context. While we cannot causally separate substantive legal impact from mere revision of beliefs, we do find strong evidence that there is indeed a “law on the market” effect as measured by the frequency of abnormal return events, and that these abnormal returns are not immediately incorporated into prices.