Tag: legal prediction

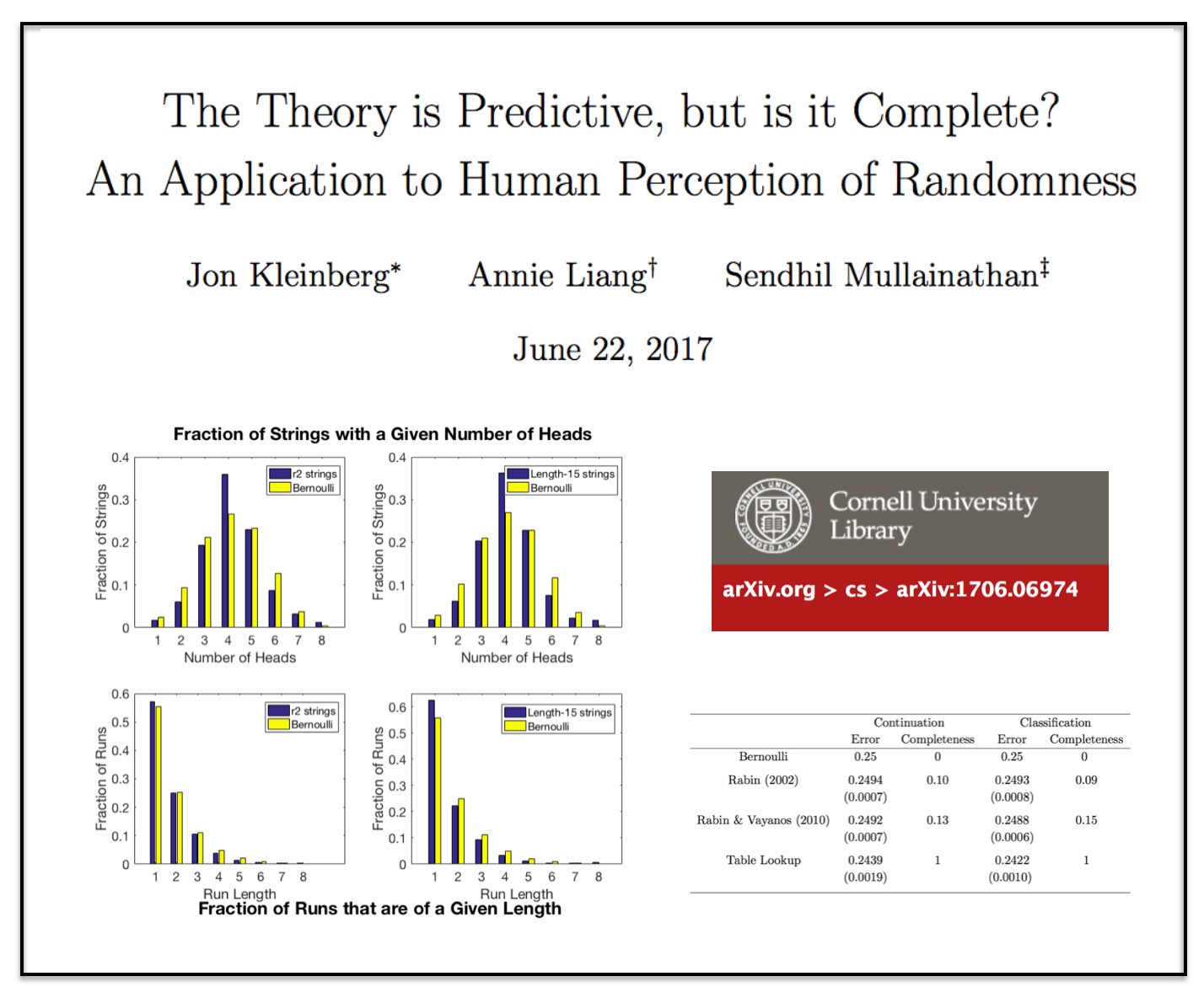

The Theory is Predictive, but is it Complete? An Application to Human Perception of Randomness

This is a very interesting paper!

This is a very interesting paper!

Law on the Market? Abnormal Stock Returns and Supreme Court Decision-Making (Version 2.01 on arXiv)

Here is Version 2.01 of the Law on the Market Paper —

From the Abstract: What happens when the Supreme Court of the United States decides a case impacting one or more publicly-traded firms? While many have observed anecdotal evidence linking decisions or oral arguments to abnormal stock returns, few have rigorously or systematically investigated the behavior of equities around Supreme Court actions. In this research, we present the first comprehensive, longitudinal study on the topic, spanning over 15 years and hundreds of cases and firms. Using both intra- and interday data around decisions and oral arguments, we evaluate the frequency and magnitude of statistically-significant abnormal return events after Supreme Court action. On a per-term basis, we find 5.3 cases and 7.8 stocks that exhibit abnormal returns after decision. In total, across the cases we examined, we find 79 out of the 211 cases (37%) exhibit an average abnormal return of 4.4% over a two-session window with an average |t|-statistic of 2.9. Finally, we observe that abnormal returns following Supreme Court decisions materialize over the span of hours and days, not minutes, yielding strong implications for market efficiency in this context. While we cannot causally separate substantive legal impact from mere revision of beliefs, we do find strong evidence that there is indeed a “law on the market” effect as measured by the frequency of abnormal return events, and that these abnormal returns are not immediately incorporated into prices.

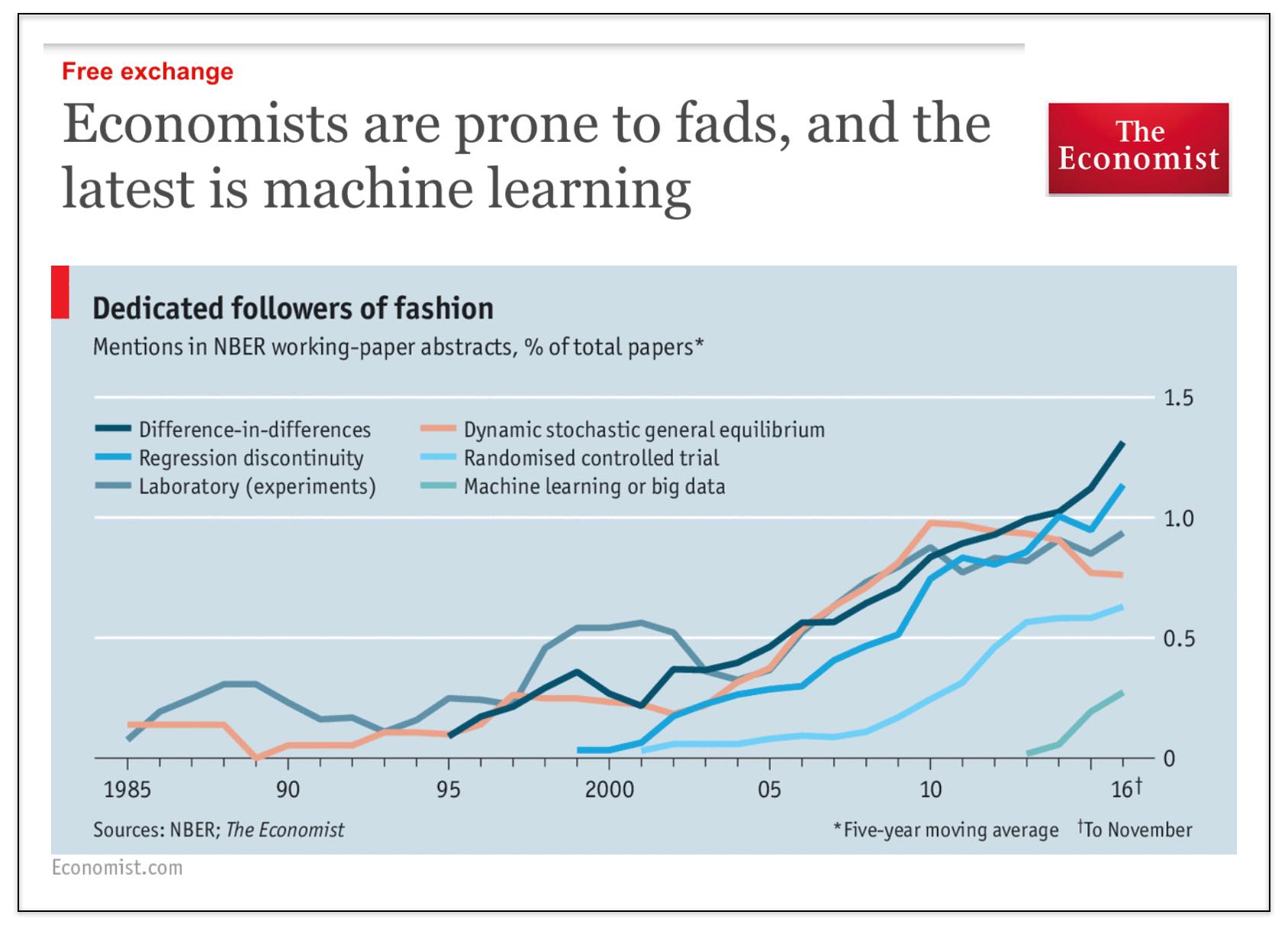

Economists are Prone to Fads, and the Latest is Machine Learning (via The Economist)

We started this blog (7 years ago) because we thought that there was insufficient attention to computational methods in law (NLP, ML, NetSci, etc.) Over the years this blog has evolved to become mostly a blog about the business of law (and business more generally) and the world is being impacted by automation, artificial intelligence and more broadly by information technology.

However, returning to our roots here — it is pretty interesting to see that the Economist has identified that #MachineLearning is finally coming to economics (pol sci + law as well).

Social science generally (and law as a late follower of developments in social science) it is still obsessed with causal inference (i.e. diff in diff, regression discontinuity, etc.). This is perfectly reasonable as it pertains to questions of evaluating certain aspects of public policy, etc.

However, there are many other problems in the universe that can be evaluated using tools from computer science, machine learning, etc. (and for which the tools of causal inference are not particularly useful).

In terms of the set of econ papers using ML, my bet is that a significant fraction of those papers are actually from finance (where people are more interested in actually predicting stuff).

In my 2013 article in Emory Law Journal called Quantitative Legal Prediction – I outline this distinction between causal inference and prediction and identify just a small set of the potential uses of predictive analytics in law. In some ways, my paper is already somewhat dated as the set of use cases has only grown. That said, the core points outlined therein remains fully intact …