Tag: economics

Judges in Jeopardy? – Actually – It is Lawyers in Jeopardy

While I really appreciate the spirit of this article, I have to say that the question posed by the author is not actually the critical one. As noted by Larry Ribstein in his post “Lawyers in Jeopardy” — the primary question raised by Watson and other forms of soft to medium artificial intelligence is their impact on the market for legal services. In thinking about this broader problem, I am haunted by the line from There Will be Blood – “I Drink Your Milkshake.” In this metaphor, technology is the straw and the legal information engineer is Daniel Day Lewis.

It is worth noting that although high-end offerings such as Watson represent a looming threat to a variety of professional services — one need not look to something as lofty as Watson to realize the future is likely to be turbulent. Law’s Information Revolution is already underway and it is a revolution in data and a revolution in software. Software is eating the world and the market for legal services has already been impacted. This is only the beginning. We are at the very cusp of a data driven revolution that will usher in new fields such as Quantitative Legal Prediction (which I have discussed here).

Pressure on Big Law will continue. Simply consider the extent to which large institutional clients are growing in their sophistication. These clients are developing the data-streams necessary to effectively challenge their legal bills. Whether this challenge is coming from corporate procurement departments, corporate law departments or with the aid of third parties — the times they are indeed a-changin’.

A variety of intermediary consulting firms and legal informatics companies have developed a robust business advising corporate clients how to find various arbitrage opportunities in the legal services market. One of the best examples is TyMetrix — who has recently leveraged more than $4 billion in legal spend data to help General Counsels and their corporate law departments drive down legal costs. Indeed, The Real Rate Report has made a huge splash (if you do know what I am talking about – I suggest you learn – because it is a pretty big deal).

Information Efficiency and Financial Stability

From the abstract: “The authors study a simple model of an asset market with informed and non-informed agents. In the absence of non-informed agents, the market becomes information efficient when the number of traders with different private information is large enough. Upon introducing non-informed agents, the authors find that the latter contribute significantly to the trading activity if and only if the market is (nearly) information efficient. This suggests that information efficiency might be a necessary condition for bubble phenomena—induced by the behavior of non-informed traders—or conversely that throwing some sands in the gears of financial markets may curb the occurrence of bubbles.” [ HT: Paul Kedrosky ]

The Great Stagnation: Why Hasn’t Recent Technology Created More Jobs? [PBS Newshour]

As part of his continuing coverage of Making Sen$e of financial news, Paul Solman reports on why more good jobs haven’t been created in recent years. Can new technological innovations create widespread job growth as past generations have seen? Tyler Cowen (George Mason / Marginal Revolution) argues “there is an innovation drought, relative to the industrial revolutions of the past and to other countries today.” Erik Brynjolfsson (MIT Solan) counters “I’m an optimist about technological progress, but I’m not nearly as optimistic about our ability to keep up with it. We have got some real problems. I just want to make it clear that the problem is not stagnation. The problem is more serious in some ways, which is our basic human ability to keep up with technological progress. That problem is going to get worse and worse as technology speeds faster and faster.”

Network Structure of Production [From PNAS]

From the abstract: “Complex social networks have received increasing attention from researchers. Recent work has focused on mechanisms that produce scale-free networks. We theoretically and empirically characterize the buyer–supplier network of the US economy and find that purely scale-free models have trouble matching key attributes of the network. We construct an alternative model that incorporates realistic features of firms’ buyer–supplier relationships and estimate the model’s parameters using microdata on firms’ self-reported customers. This alternative framework is better able to match the attributes of the actual economic network and aids in further understanding several important economic phenomena.”

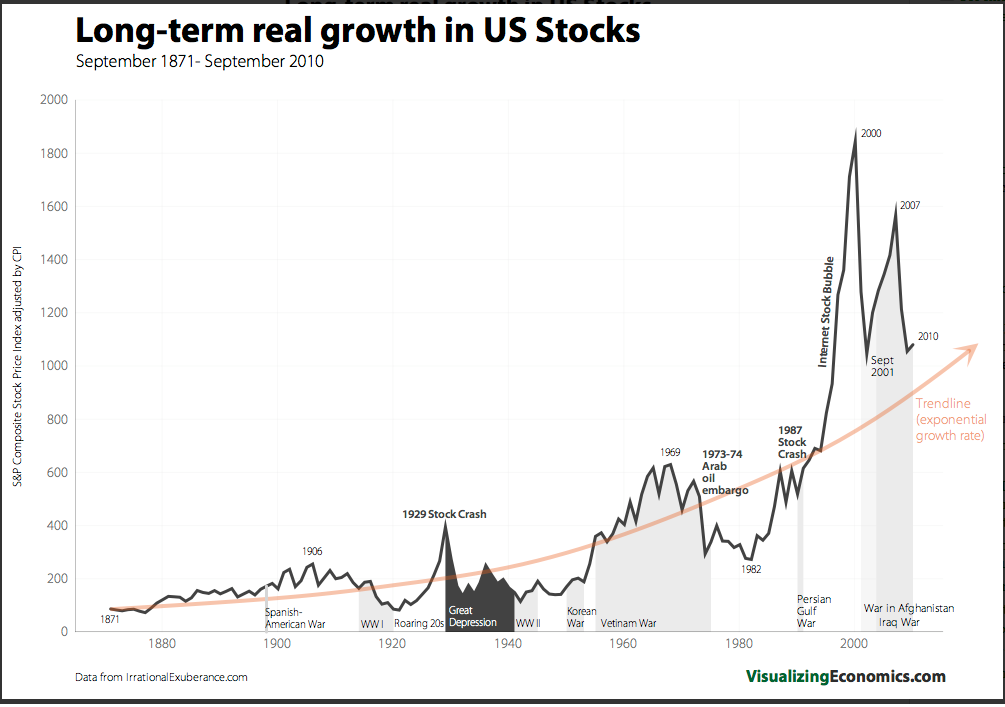

Exponential Growth Rate of US Stocks since 1871 [ Via Visualizing Economics ]

If you would like to see this chart plotted on a log scale click here. Also, Visualizing Economics has a number of other very interesting projects worth checking out.