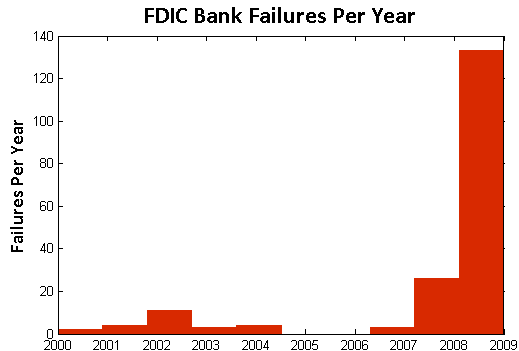

Visualizing Bank Failures ( 2008 – 2009 )

Three Takeaways

- Acceleration: There were four failures in the first six months of 2008, followed by another 22 failures in the next six months. By January of 2009, there were 21 failures in the first three months of the year, followed by 138 from April to last Friday.

- Magnitude: Failures in the past two years have cost the Depositors Insurance Fund an estimated $57B. The IndyMac failure of July 2008 accounted for $10B alone, followed by BankUnited at $4.9B and Guaranty Banks at $3B.

- Spatial Correlation: There is a significant amount of spatial correlation in California, Georgia, Florida, Texas, and Illinois. These states account for 77% of the total costs to the Depositors Insurance Fund. Furthermore, most of the losses in California and Georgia were concentrated highly around a few urban centers.

The Movie

The movie below shows the location of bank failures, beginning in 2008 and concluding with the three failed banks from Friday, December 11, 2009. Each green circle corresponds to a bank failure, and the size of each circle corresponds logarithmically to the FDIC’s estimated cost for the Depository Insurance Fund, as stated in the FDIC press releases. For failures with joint press releases, such as the 9 banks that failed on October 30th, the circles are sized in proportion to their relative total deposits.

Our visualization is similar to this one offered by the Wall Street Journal. For sizing the circles, the WSJ relied upon the value of assets at the time of failure. By contrast, our approach focuses upon the estimated impact to the Depositors Insurance Fund (DIF). In several instances, this alternative approach leads to a different qualitative result than the WSJ. For example, consider the case of Washington Mutual. While many have characterized Washington Mutual’s failure as the largest in history, according to the FDIC press release the failure did not actually lead to a draw upon Depositors Insurance Fund. By contrast, the FDIC estimated cost for the IndyMac Bank failure was substantial– the latest available estimate sets it at 10.7 billion.

Additional Background

As reported in a number of news outlets, Friday witnessed the failure of three more banks – Solutions Bank (Overland Park, KS), Valley Capital Bank (Mesa, AZ), and Republic Federal Bank (Miami, FL).

According to information obtained from the Federal Deposit Insurance Corporation (FDIC), there have been a total of 186 bank failures in the United States since 2000. Of these, 159 banks or roughly 85% have occurred in the past two years. The plot below displays the yearly failures since 2000. These 159 failures over the past two years have cost the Depositors Insurance Fund an estimated $57B.

In addition to the increase in the rate of bank failures, there has also been a substantial amount of spatial correlation between these failures. The table below shows the five states with the highest estimated total costs to the Depositors Insurance Fund since 2008. Together, these five states account for $44B of the total $57B in the past two years.

| State | Estimated Cost to Fund |

| California | $19.33B |

| Georgia | $9.29B |

| Florida | $6.77B |

| Texas | $4.56B |

| Illinois | $4.12B |

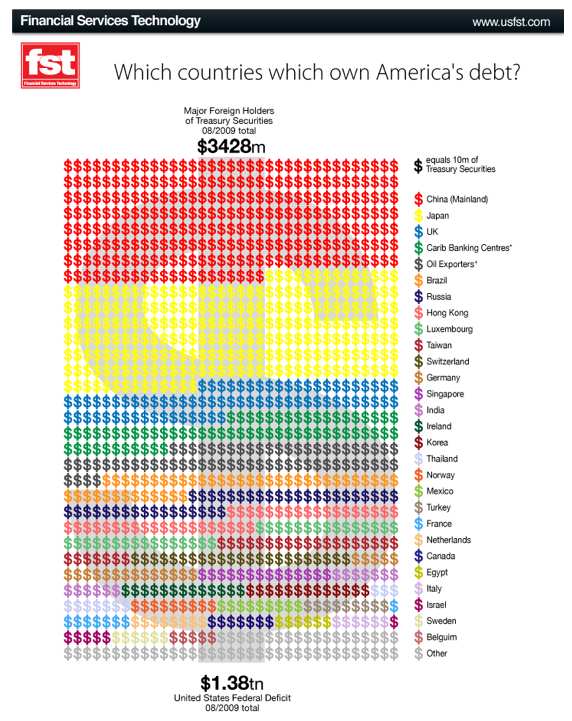

Who Owns America’s Debt? An Dynamic Perspective on the Major Foreign Holders of Treasury Securities [2002- Present]

Three Things to Notice

(1) China Passes Japan — This dynamic visual demonstrates how in the fall of 2008 China surpassed Japan as the top foreign holder of U.S. Debt.

(2) The Rise of Russia — Notice how Russia becomes a significant holder of U.S. Debt between late-2006 and mid-2007.

(3) The Increasing Amount of U.S. Debt Held Abroad — The pie chart is sized by the total debt held by the current top ten debt holders. As a function of U.S. expenditures over the relevant time period, this pie grows in nearly every time period. In the bottom right corner, we track the total debts held by the current top debt holders. Of course, this alone does not represent the complete picture as there is additional U.S. debt held by a variety of other other countries. Therefore, we also track the grand total of all debts held abroad in the bottom right corner of the visual.

Dynamic Perspective on the Increasing Amount of American Debt Held Abroad

Focusing upon the “Major Foreign Holders of Treasury Securities,” we were interested in considering how today’s major debt holders acquired their top position. The data used the generate the visual above is drawn from United States Department of Treasury. For those interested in replicating our results, the current data is located here and the historical data is located here.

Cash for Clunkers – Visualization and Analysis

Cash for Clunkers: A Dynamic Map of the Cash Allowance Rebate Systems (CARS)

Some Background on the Car Allowance Rebate System (CARS)

From the official July 27, 2009 press release – “The National Highway Traffic Safety Administration (NHTSA) also released the final eligibility requirements to participate in the program. Under the CARS program, consumers receive a $3,500 or $4,500 discount from a car dealer when they trade in their old vehicle and purchase or lease a new, qualifying vehicle. In order to be eligible for the program, the trade-in passenger vehicle must: be manufactured less than 25 years before the date it is traded in; have a combined city/highway fuel economy of 18 miles per gallon or less; be in drivable condition; and be continuously insured and registered to the same owner for the full year before the trade-in. Transactions must be made between now [July 27, 2009] and November 1, 2009 or until the money runs out.”

On August 6, 2009, Congress extended the program adding $2 billion dollars to the program’s initial allocation. For those interested in background, feel free to read the CNN report on the program extension.

On August 13, 2009, the Secretary offered this press release noting “[T]he Department of Transportation today clarified that consumers who want to purchase new vehicles not yet on dealer lots can still be eligible for the CARS program. Dealers and consumers who have reached a valid purchase and sale agreement on a vehicle already in the production pipeline will be able to work with the manufacturer to receive the documentation needed to qualify for the program.”

On August 20, 2009, the Secretary announced the program would end on August 24, 2009 at 8pm EST. While this remained the deadline for sales, dealers were provided a small extension to file paperwork ( Noon on August 25, 2009). For those interested, all other press releases are available here.

The Cars.gov DataSet

The full data set is available for download here. From the Cars.gov website “these reports contain the transaction level information entered by participating dealers for the 677,081 CARS transactions that were paid or approved for payment as of Friday, October 16, 2009 at 3:00PM EDT for a total of $2,850,162,500. Please note that confidential financial or commercial information and consumer information protected under the DOT privacy policy has been redacted.” The official cars.gov website offers additional caveats on its note to analysts. One important thing to note, there is a statutory exemption which allowed transactions to occur pursuant to an amended rule after the August 24, 2009 termination date. Here is the relevant language of the amended rule:

“To qualify for the exception process, a dealer must have been prevented from submitting an application for reimbursement due to a hardship caused by the agency. Specifically, a dealer may request an exception if the dealer was locked out of the CARS system, contacted NHTSA for a password reset prior to the announced deadline, but did not receive a password reset. A dealer also may request an exception if its timely transaction was rejected by the CARS system due to a duplicate State identification number, trade-in vehicle VIN, or new vehicle VIN that was never used for a submitted CARS transaction, if the dealer contacted NHTSA prior to the announced deadline to resolve the issue but did not receive a resolution. Finally, a dealer may seek an exception if it was prevented from submitting a transaction by the announced deadline due to another hardship attributable to NHTSA’s action or inaction, upon submission of proof and justification satisfactory to the Administrator.”

For those who have downloaded the full set, the above passage explains why there exist transaction data which fall outside of the general CARS program window.

Dynamic Visualization of the Spatial Distribution of Sales

Each time step of the animation represents a day for which there exists data in the CARS official dataset. While the program officially started on July 27, 2009, the dataset contains both transactions undertaken during the pilot program as well as transactions undertaken pursuant the exemption process described above. Thus, the movie begins with the first unit of observation on July 1, 2009 and terminates with the final transaction on October 24, 2009. Similar to a flip book, the movie is generated by threading together each daily time slice.

The Size and Color of Each Circle

Each circle represents a zip code in which one or more participating dealerships is located. The radius of a given circle is function of the number of CARS related sales in a given zip code as of the date in question. In each day, the circle is colored if there is at least one sale in the current period while the circle is resized based upon the number of sales in the given period.

In the later days of the data window, particular those after official August 25 termination of the program, the daily sales are fairly negligible. However, as outlined in the dataset description above, each participating institution who qualified for the exemption was allowed to submit transactions beyond official program termination date. Notice the cumulative percentage of sales reach nearly all total sales by August 25th. Virtually all sales occur during the official July 27, 2009 – August 24, 2009 window. Thus, while these the stragglers caused certain circles to remain illuminated the size of circles is essentially fixed after August 24, 2009.

Some Things to Notice in the Visualization

In the lower left corner of the video, you will notice two charts. The chart on the left tracks the contribution to total sales for the given day. The chart on the right represent the cumulative percentage of sales to date under the program. Not surprisingly, most of the transactions under the CARS program take place between July 27, 2009 – August 24, 2009 time window.

Within this window, the daily sales feature a variety of interesting trends. During each Sunday of the program (i.e. August 2nd, August 9th, August 16th & August 23rd) sales were significantly diminished. Not surprisingly, the end of week and early weekend sales tend to be the strongest.

In the very early days of the program, there were a variety of media reports (e.g. here, here, here) highlighting the quickly dimishing resources under the program. Obviously, it is difficult to determine the underlying demand for the program. However, given the extent of the acceleration, it appears these reports contributed to the rapid depletion of the initial 1 billion dollars allocated under the program. A similar but less pronounced form of herding also accompanied the last days of the CARS program.

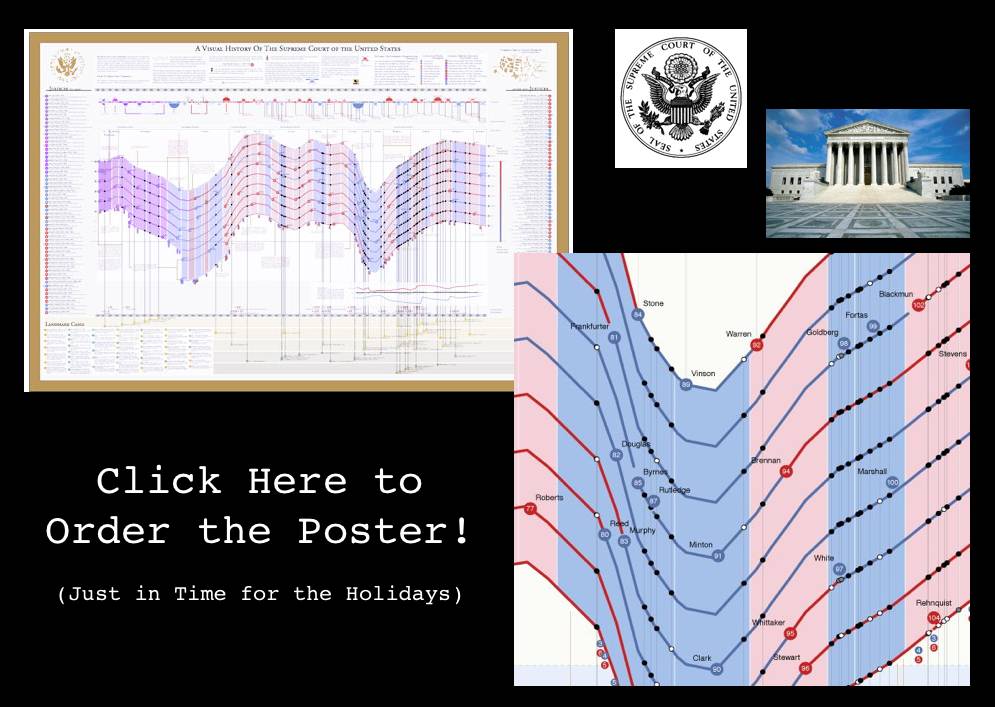

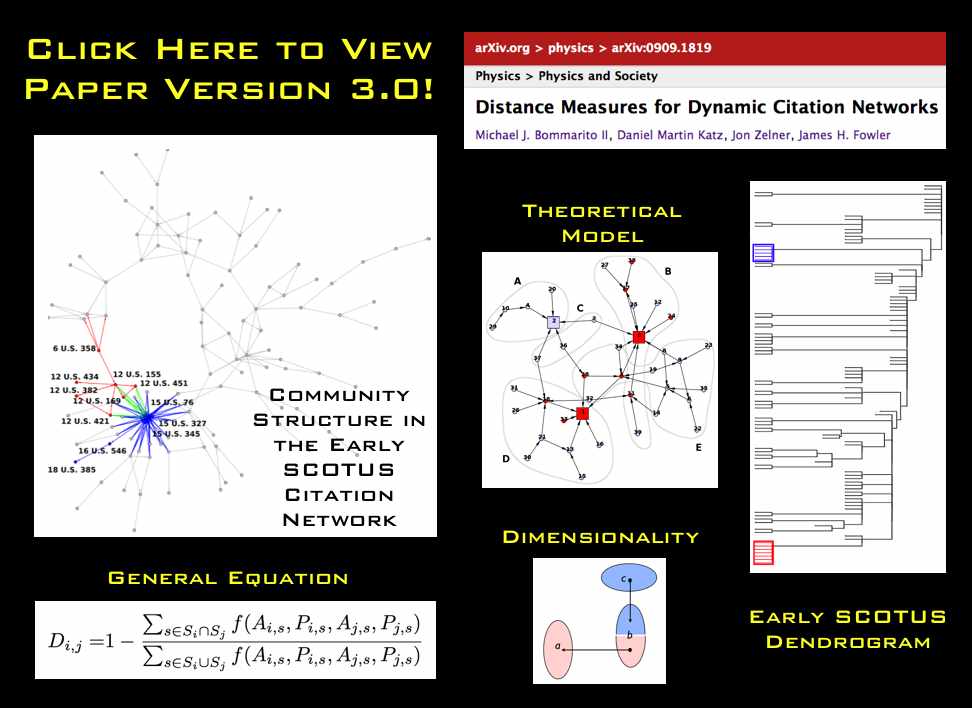

The Supreme Court Open Infrastructure Project Meeting

Mike and I just spent a couple days a Washington University’s Center for Empirical Research in the Law for a meeting related to the Supreme Court Open Infrastructure Project. The meeting featured a number of great folks with cool data projects. The discussion was very fruitful and it is clear that the end product is going to offer a wide range of data relevant resources. We are looking forward to contribute to the project in the months to come!

Sen. Sheldon Whitehouse on the Senate Floor Discussing the Length of the Health Care Bill and Citing Harry Potter Number [Via Think Progress]

Full Story over at Think Progress. Our original post on the length of HR 3962 is here. The subsequent NY Times Article on the Length of HR 3962 is here. Enjoy!

Dynamic Animation of the East Anglia Climate Research Unit Email Network

FULL SCREEN FOR BETTER VIEWING!

Click on this icon to view the Movie in Full Screen Mode!![]()

STATIC SNAPSHOT TO DYNAMIC ANIMATION

In our prior post analyzing the email database of Climate Research Unit at the University of East Anglia, we aggregated all emails over the relevant 1997-2009 time period into a single static visualization. Specifically, to build the network, we processed every email in the leaked data. Each email contains a sender and at least one recipient on the To:, Cc:, or Bcc: line.

One obvious shortcoming associated with producing a static snapshot for data set, is that it often obscures the time evolving dynamics of interaction which produced the full graph. To generate a dynamic picture, it is necessary to collect time stamped network data. In the current case, this required acquisition of the date field for each of the emails. With this information, we used the same underlying data to generate a dynamic network animation for the 1997-2009 time window.

HOW TO INTERPET THE MOVIE

Consistent with the approach offered in our prior visualization, each node represents an individual within the email dataset while each connection reflects the weighted relationship between those individuals. The movie posted above features the date in the upper left. As time ticks forward, you will notice that the relative social relationships between individuals are updated with each new batch of emails. In some periods, this updating has significant impact upon the broader network topology and at other time it imposes little structural consequences.

In each period, both new connections as well as new communications across existing connections are colored teal while the existing and dormant relationships remain white. Among other things, this is useful because it identifies when a connection is established and which interactions are active at any given time period.

A SHORT VERSION AND A LONG VERSION

We have two separate versions of the movie. The version above is a shorter version where roughly 13 years is displayed in under 2 minutes. In the coming days, we will have a longer version of the movie which ticks a one email at a time. In both versions, each frame is rendered using the Kamada-Kawai layout algorithm. Then, the frames are threaded together using linear interpolation.

SELECTION EFFECTS

Issues of selection of confront many researchers. Namely, given the released emails are only a subset of the broader universe of emails authored over the relevant time window, it is important to remember that the data has been filtered and the impact of this filtration can not be precisely determined. Notwithstanding this issue, our assumption is that every email from a sender to a recipient represents a some level of relationship between them. Furthermore, we assume that more emails sent between two people generally indicates a stronger relationship between those individuals.

DIMENSIONALITY

In our academic scholarship, we have confronted questions of dimensionality in network data. Simply put, analyzing network data drawn from high dimensional space can be really thorny. In the current context, a given email box likely contains emails on lots of subjects and reflects lots of people not relevant to the specific issue in question. Again, while we do not specifically know the manner in which the filter was applied, it is certainly possible that the filter actually served to mitigate issues of dimensionality.

ACCESS THE DATA

For those interested in searching the emails, the NY Times directs the end user to http://www.eastangliaemails.com/

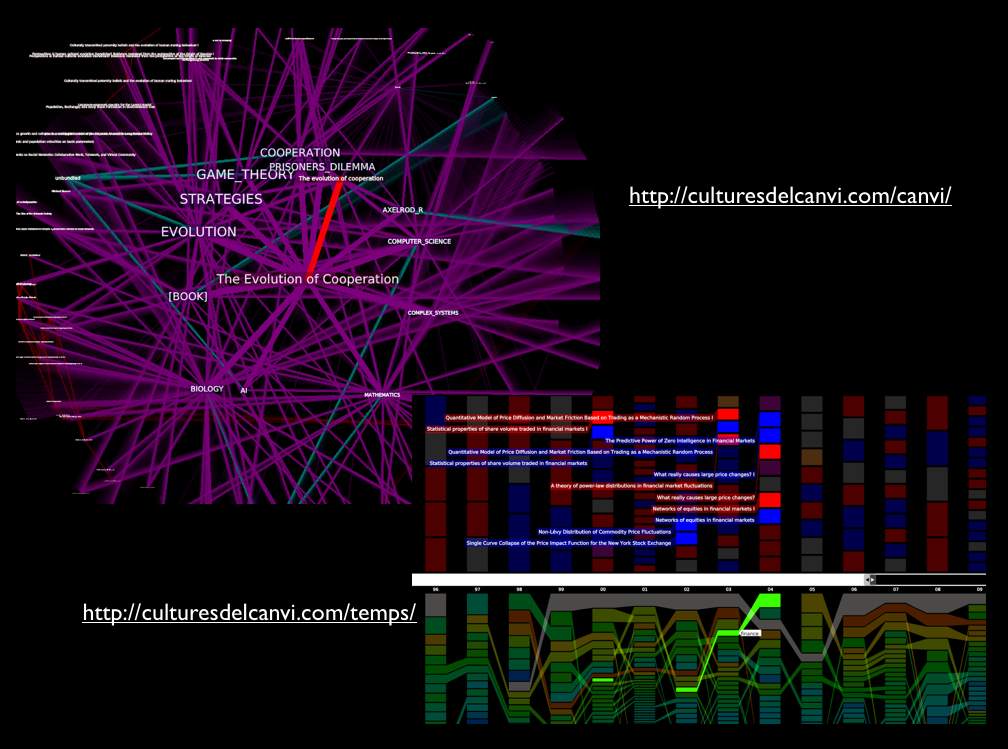

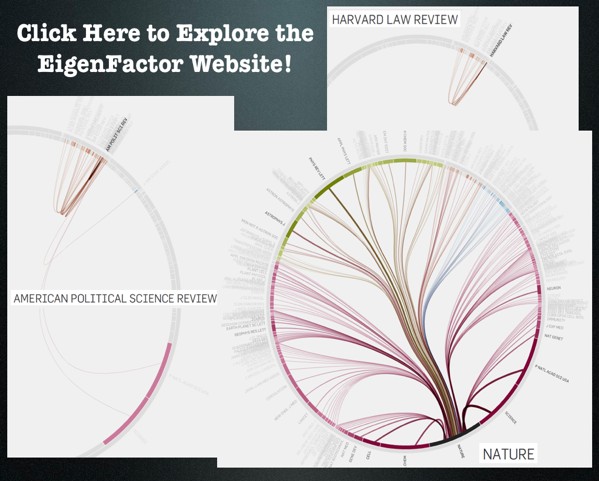

Well Formed Eigenfactor.Org–Wonderful Visualization of CrossDisciplinary Fertilization, Information Flow & The Structure of Science [Repost]

Given our interest in both interdisciplinary scholarship and the spread of ideas, we wanted to highlight one of our favorite projects–eigenfactor.org. Here is basic documentation from their website. There are also links to academic papers offering far more detailed documentation for the data and algorithm choice. In particular, read Martin Rosvall and Carl T. Bergstrom, Maps of Random Walks on Complex Networks, Proc. of the Nat. Academy of Sci. 105:1118-1123 (2007). The above visualizations are written in Flare by Moritz Stefaner. Click on the slide above to reach these interactive visualizations. These mapping offer reveal the reach of various publications across disciplines–some are insular and others have incredible reach. The inner rings are journals and the outer rings are the host disciplines. Enjoy!

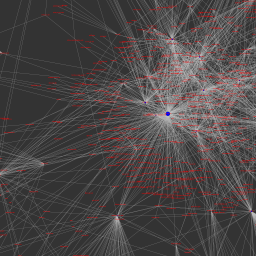

Visualizing the East Anglia Climate Research Unit Leaked Email Network

As reported in a wide variety of news outlets, last week, a large amount of data was hacked from the Climate Research Unit at the University of East Anglia. This data included both source code for the CRU climate models, as well as emails from the individuals involved with the group. For those interested in background information, you can read the NY Times coverage here and here. Read the Wall Street Journal here. Read the Telegraph here. For those interested in searching the emails, the NY Times directs the end user to http://www.eastangliaemails.com/.

Given the data is widely available on the internet, we thought it would be interesting to analyze the network of contacts found within these leaked emails. Similar analysis has been offered for large datasets such as the famous Enron email data set. While there may be some selection issues associated with observing this subset of existing emails, we believe this network still gives us a “proxy” into the structure of communication and power in an important group of researchers (both at the individual and organization level).

To build this network, we processed every email in the leaked data. Each email contains a sender and at least one recipient on the To:, Cc:, or Bcc: line. The key assumption is that every email from a sender to a recipient represents a relationship between them. Furthermore, we assume that more emails sent between two people, as a general proposition indicates a stronger relationship between individuals.

To visualize the network, we draw a blue circle for every email address in the data set. The size of the blue circle represents how many emails they sent or received in the data set – bigger nodes thus sent or received a disproportionate number of emails. Next, we draw grey lines between these circles to represent that emails were sent between the two contacts. These lines are also sized by the number of emails sent between the two nodes.

Typically, we would also provide full labels for nodes in a network. However, we decided to engage in partial “anonymization” for the email addresses of those in the data set. Thus, we have removed all information before the @ sign. For instance, an email such as johndoe@umich.edu is shown as umich.edu in the visual. If you would like to view this network without this partial “anonymization,” it is of course possible to download the data and run the source code provided below.

Note: We have updated the image. Specifically, we substituted a grey background for the full black background in an effort to make the visual easier to read/interpret.

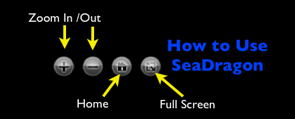

Click here for a zoomable version of the visual on Microsoft Seadragon.

Don’t forget to use SeaDragon’s fullscreen option:

Hubs and Authorities:

In addition to the visual, we provide hub and authority scores for the nodes in the network. We provide names for these nodes but do not provide their email address.

Authority

- Phil Jones: 1.0

- Keith Briffa: 0.86

- Tim Osborn: 0.80

- Jonathan Overpeck: 0.57

- Tom Wigley: 0.54

- Gavin Schmidt: 0.54

- Raymond Bradley: 0.52

- Kevin Trenberth: 0.49

- Benjamin Santer: 0.49

- Michael Mann: 0.46

Hubs returns nearly identical ranks with slightly perturbed orders with the notable exception that the UK Met Office IPCC Working Group has the highest hub score.

Thus, so far as these emails are a reasonable “proxy” for the true structure of this communication network, these are some of the most important individuals in the network.

Source Code:

Unlike some existing CRU code, the code below is documented, handles errors, and is freely available.