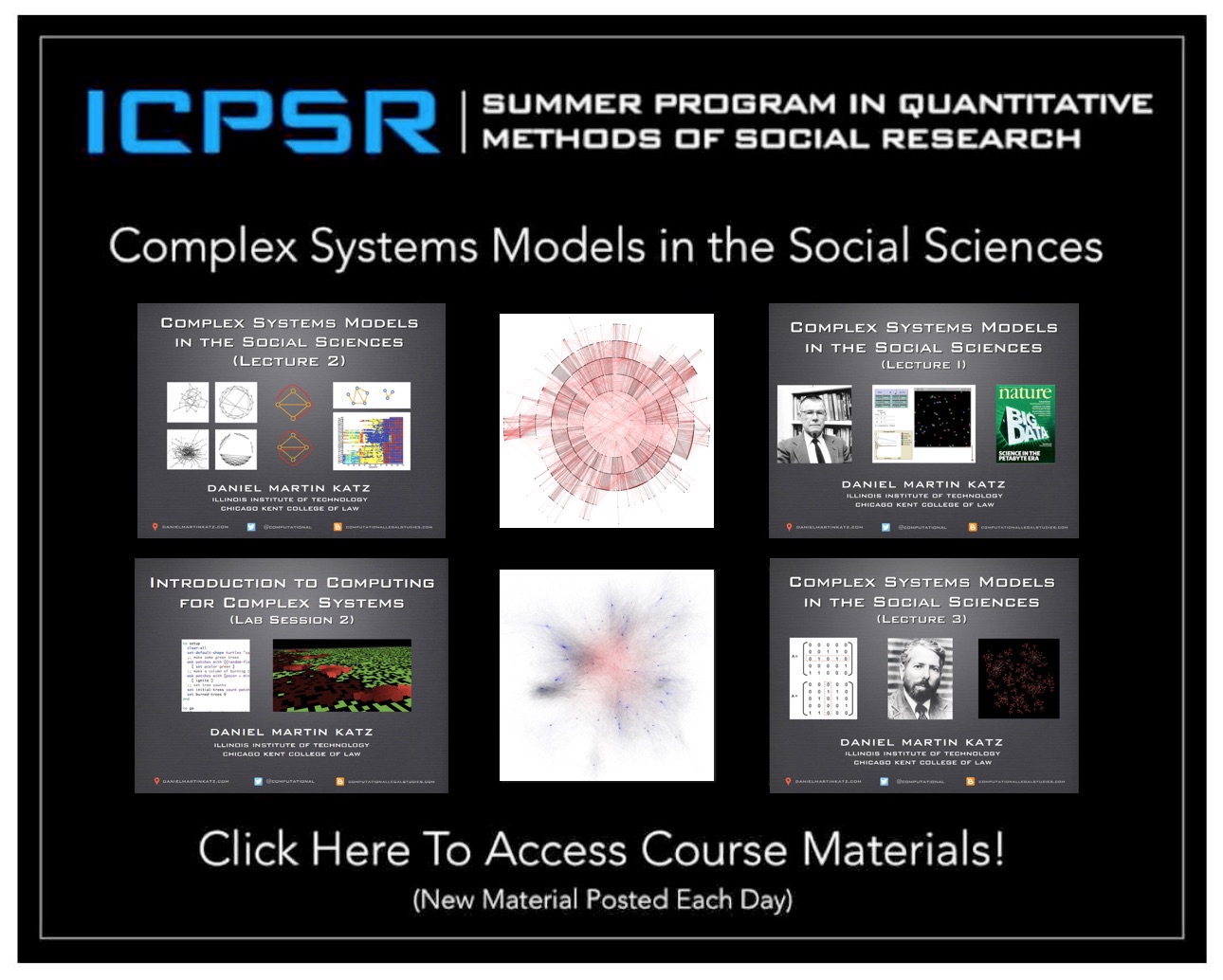

Teaching the Complex Systems Course @ University of Michigan ICPSR Summer Program in Quantitative Methods

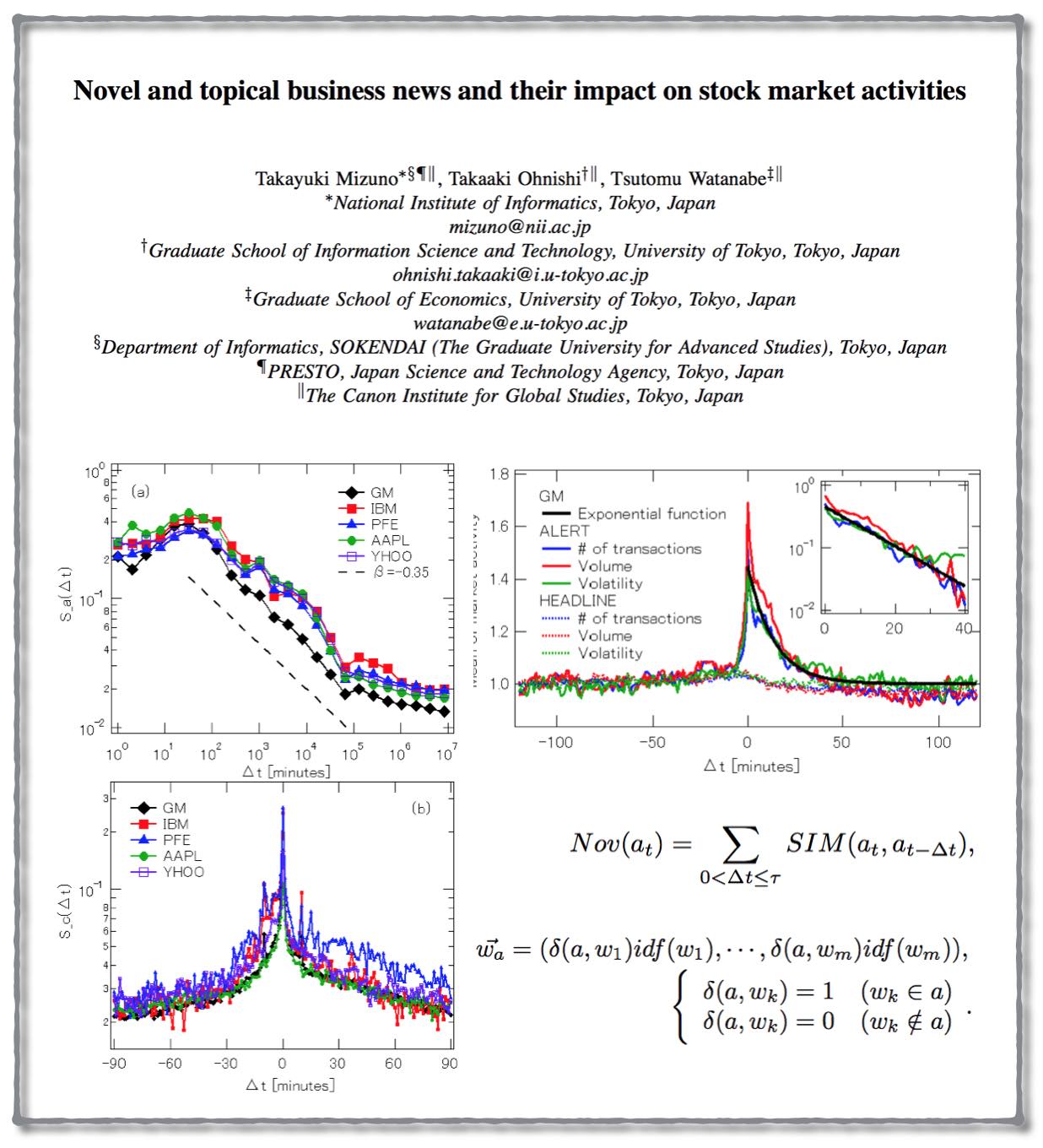

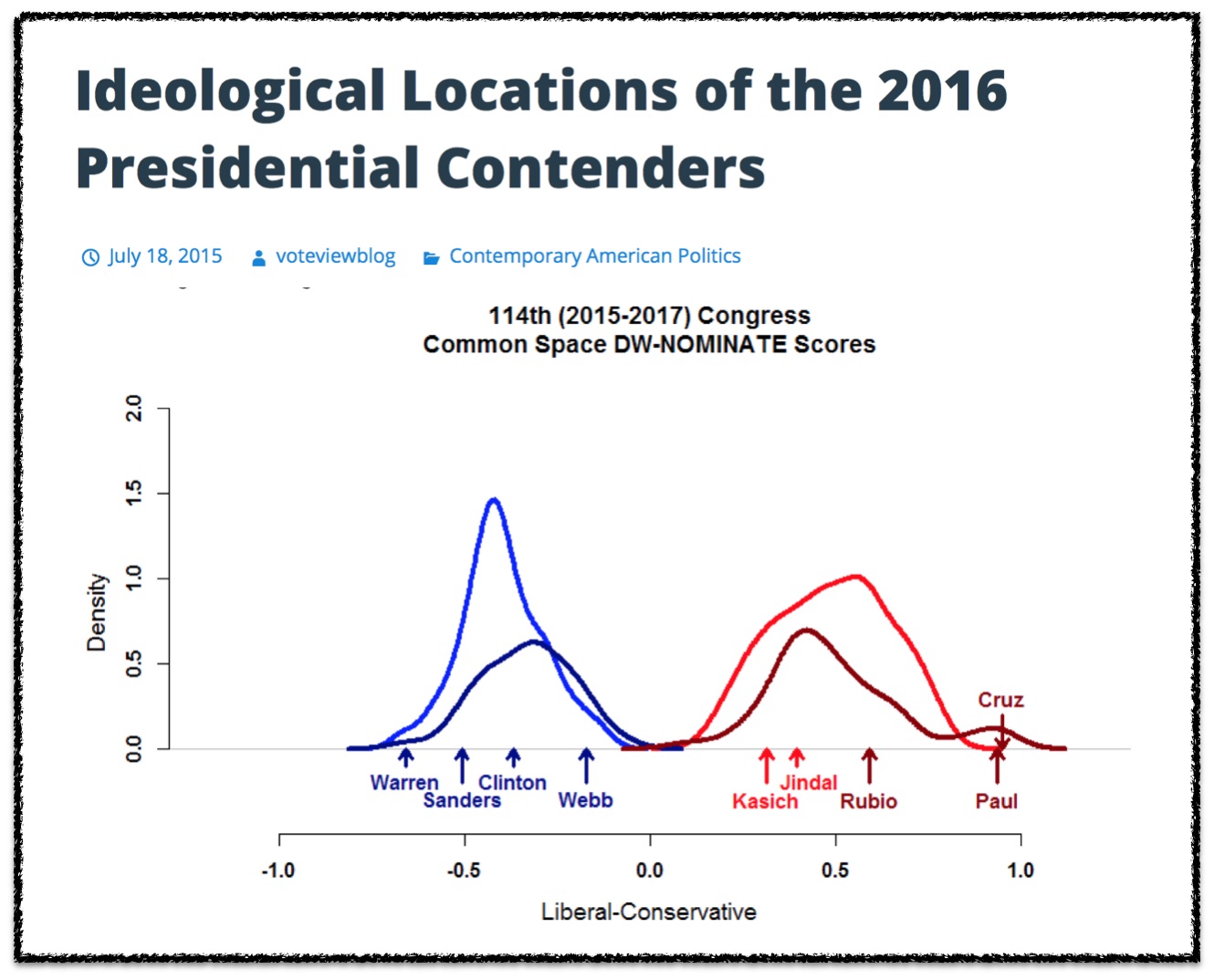

This upcoming week and next week I have the pleasure of teaching “Complex Systems Models in the Social Sciences” here at the University of Michigan ICPSR Summer Program in Quantitative Methods. The field of complex systems is very diverse and it is difficult to do complete justice to the range of scholarship conducted under this umbrella in a short survey course. However, we strive to cover the canonical topics such as computational game theory and computational modeling, network science, natural language processing, randomness vs. determinism, diffusion, cascades, emergence, empirical approaches to study complexity (including measurement), social epidemiology, non-linear dynamics, etc. Click here or on the image above to access my course materials!

This upcoming week and next week I have the pleasure of teaching “Complex Systems Models in the Social Sciences” here at the University of Michigan ICPSR Summer Program in Quantitative Methods. The field of complex systems is very diverse and it is difficult to do complete justice to the range of scholarship conducted under this umbrella in a short survey course. However, we strive to cover the canonical topics such as computational game theory and computational modeling, network science, natural language processing, randomness vs. determinism, diffusion, cascades, emergence, empirical approaches to study complexity (including measurement), social epidemiology, non-linear dynamics, etc. Click here or on the image above to access my course materials!

Using Technology and System Design to Improve the Dodd-Frank Resolution Planning Requirement (+ Better Manage Complexity)

This past week, I had the pleasure of participating in a half day closed door session with about ~40-50 folks from the financial services industry including several of the world’s finest law firms, representatives from SIFI and non-SIFI financial institutions as well as folks from IBM Watson and LegalOnRamp (a Watson eco-system partner).

The specific subject was RRP – the resolution planning / living wills requirement under Dodd Frank. Former Congressman Barney Frank provided opening remarks and joined the group for the balance of the half day session. Paul Lippe and I discussed our recent paper on Resolution Planning that was published in Banking Perspective (The Journal of The Clearing House).

As we argue in the paper, the ‘too big to fail argument’ is not really that intellectually forceful. The question – properly posed – is what to do about complexity and the management of complex systems. The complex and interdependent nature of the banking ecosystem is the feature that really challenges efforts to develop robust regulatory / management structures. This would be true even if existing financial institutions were made smaller.

Our conversation was about how to use technology and system redesign to confront and manage wide scale complexity. The resolution planning challenge should not just be focused upon clearing the existing regulatory hurdle but actually can be an opportunity for organizations to build better financial/legal information infrastructure (ultimately leading to an internet of contracts or more broadly an internet of legal things). In building a better financial/legal information infrastructure, banks will be better positioned to manage/properly price risk.