It was my great pleasure to speak at the FT Innovative Lawyers Summit here in London !

Tag: legal tech

Digital Coins Are So Hot, Startups Are Selling Them Like an IPO (via Bloomberg)

ICO vs IPO … ICO’s are So Hot – “ICOs may seem to fall into a legal gray area, but she says the vast majority of tokens count as securities, and if they are sold to investors in the U.S., they fall under the jurisdiction of the Securities and Exchange Commission … The SEC has yet to wade in, but the hotter the ICO market, the greater the potential for abuse or investor losses that could spur the agency to act. Channing suspects the regulators are waiting for the right case.”

The Development of Structure in the Citation Network of the United States Supreme Court

This is one of our all time best efforts from a scientific perspective (and it is now 7 years old). We did a rehash of it in our recent paper in the March 31, 2017 edition of Science magazine.

What are some of the key takeaway points?

(1) The Supreme Court’s increasing reliance upon its own decisions over the 1800-1830 window.

(2) The important role of maritime/admiralty law in the early years of the Supreme Court’s citation network. At least with respect to the Supreme Court’s citation network, these maritime decisions are the root of the Supreme Court’s jurisprudence.

(3) The increasing centrality of decisions such as Marbury v. Madison, Martin v. Hunter’s Lessee to the overall network.

The Development of Structure in the SCOTUS Citation Network

The visualization offered above is the largest weakly connected component of the citation network of the United States Supreme Court (1800-1829). Each time slice visualizes the aggregate network as of the year in question.

In our paper entitled Distance Measures for Dynamic Citation Networks, we offer some thoughts on the early SCOTUS citation network. In reviewing the visual above note ….“[T]he Court’s early citation practices indicate a general absence of references to its own prior decisions. While the court did invoke well-established legal concepts, those concepts were often originally developed in alternative domains or jurisdictions. At some level, the lack of self-reference and corresponding reliance upon external sources is not terribly surprising. Namely, there often did not exist a set of established Supreme Court precedents for the class of disputes which reached the high court. Thus, it was necessary for the jurisprudence of the United States Supreme Court, seen through the prism of its case-to-case citation network, to transition through a loading phase. During this loading phase, the largest weakly connected component of the graph generally lacked any meaningful clustering. However, this sparsely connected graph would soon give way, and by the early 1820’s, the largest weakly connected component displayed detectable structure.”

We also explore this network in our 2010 paper — Michael Bommarito, Daniel Martin Katz, Jonathan Zelner & James Fowler, Distance Measures for Dynamic Citation Networks 389 Physica A 4201 (2010) < SSRN > < arXiv >

Robert Ambrogi on Harvard’s Statement re Ravel Law’s Acquisition By LexisNexis

Coverage from Bob Ambrogi here. The Harvard Law statement notwithstanding – I doubt that either Lexis, Harvard Law or Ravel will provide yield the pathbreaking access at scale that was advertised in the original announcement. So I take this is a fairly negative development for this space – but feel free to prove me wrong …

Coverage from Bob Ambrogi here. The Harvard Law statement notwithstanding – I doubt that either Lexis, Harvard Law or Ravel will provide yield the pathbreaking access at scale that was advertised in the original announcement. So I take this is a fairly negative development for this space – but feel free to prove me wrong …

Thanks to the Scotland Legal Hackers for the Promos for Programming for Lawyers Event

I appreciate my friends at Scotland Legal Hackers going the extra mile to promote my talk (given remotely) in advance of their {Programming + Law} session – note: the person who ought to give this talk is really Michael J Bommarito II

I appreciate my friends at Scotland Legal Hackers going the extra mile to promote my talk (given remotely) in advance of their {Programming + Law} session – note: the person who ought to give this talk is really Michael J Bommarito II

Opening Remarks at the Scotland Legal Hackers – Programming for Lawyers Event

Next week, I will be speaking (remotely) at the Scotland Legal Hackers – Programming for Lawyers Event in Edinburgh. Legal Innovation is a global movement and the Legal Hacker groups around the world represent a very important community of change agents.

Next week, I will be speaking (remotely) at the Scotland Legal Hackers – Programming for Lawyers Event in Edinburgh. Legal Innovation is a global movement and the Legal Hacker groups around the world represent a very important community of change agents.

IE LawX 2017 in Madrid – Presented by IE Law School in Collaboration Stanford CodeX

It was my great pleasure to give the opening Keynote Address at IE LawX 2017. I would like to extend my thanks to IE Law School, Dean Javier de Cendra and to all of the team who put on a fantastic event on #LegalTech #LegalInnovation #LegalAI!

It was my great pleasure to give the opening Keynote Address at IE LawX 2017. I would like to extend my thanks to IE Law School, Dean Javier de Cendra and to all of the team who put on a fantastic event on #LegalTech #LegalInnovation #LegalAI!

Law on the Market? Abnormal Stock Returns and Supreme Court Decision-Making (Version 2.01 on arXiv)

Here is Version 2.01 of the Law on the Market Paper —

From the Abstract: What happens when the Supreme Court of the United States decides a case impacting one or more publicly-traded firms? While many have observed anecdotal evidence linking decisions or oral arguments to abnormal stock returns, few have rigorously or systematically investigated the behavior of equities around Supreme Court actions. In this research, we present the first comprehensive, longitudinal study on the topic, spanning over 15 years and hundreds of cases and firms. Using both intra- and interday data around decisions and oral arguments, we evaluate the frequency and magnitude of statistically-significant abnormal return events after Supreme Court action. On a per-term basis, we find 5.3 cases and 7.8 stocks that exhibit abnormal returns after decision. In total, across the cases we examined, we find 79 out of the 211 cases (37%) exhibit an average abnormal return of 4.4% over a two-session window with an average |t|-statistic of 2.9. Finally, we observe that abnormal returns following Supreme Court decisions materialize over the span of hours and days, not minutes, yielding strong implications for market efficiency in this context. While we cannot causally separate substantive legal impact from mere revision of beliefs, we do find strong evidence that there is indeed a “law on the market” effect as measured by the frequency of abnormal return events, and that these abnormal returns are not immediately incorporated into prices.

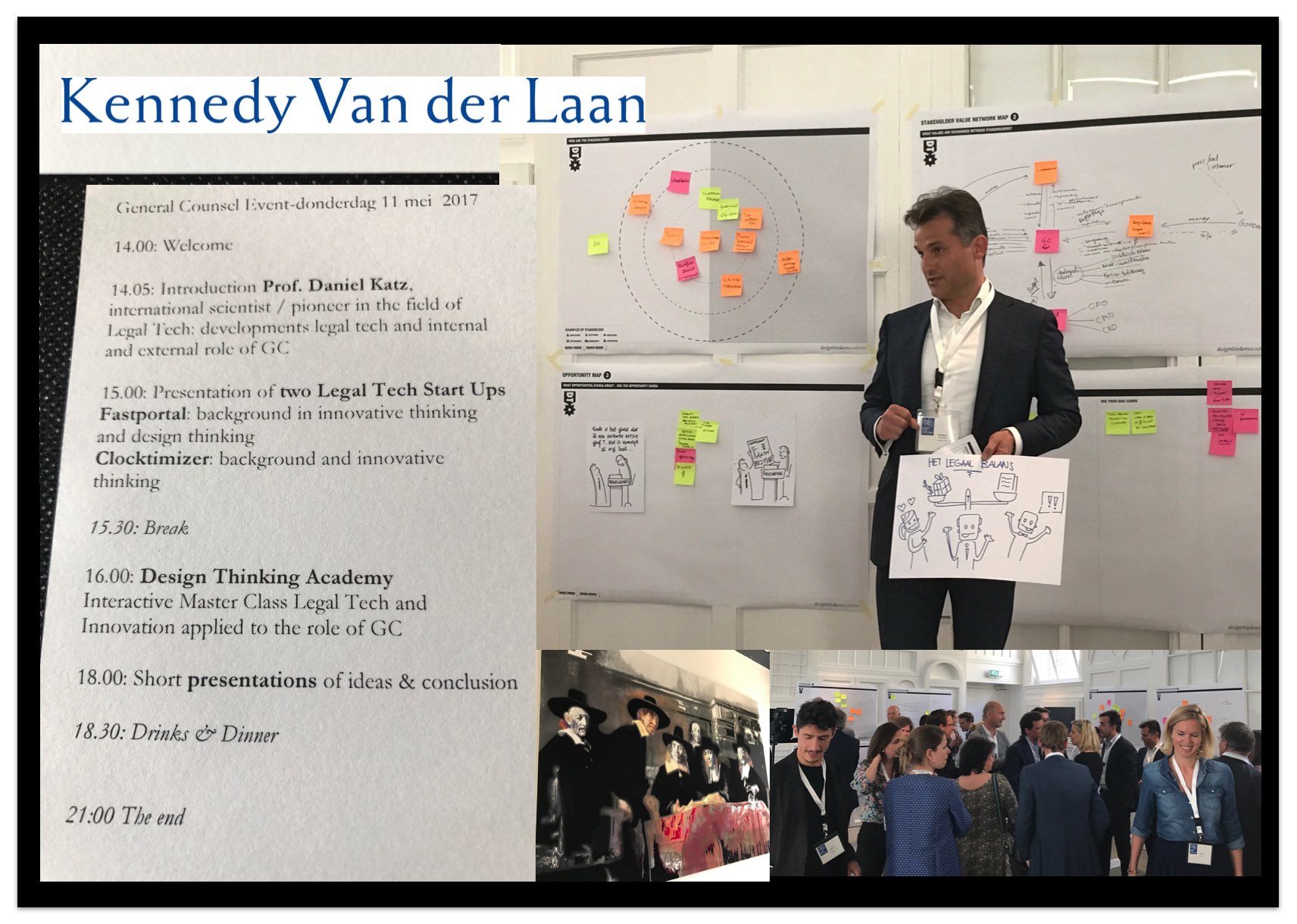

Presentation at Legal Innovation Event with Kennedy Van Der Laan and European General Counsels

As my part of my final day in Amsterdam – it was my great pleasure to join with my friends from the Dutch Law Firm – Kennedy Van Der Laan (co-founded by the Mayor of Amsterdam Eberhard van der Laan) for a Legal Innovation Event. The event combined sessions in data, technology and design thinking for a variety of European General Counsels.

Speech at the Dutch Legal Tech Meetup – Amsterdam

A great group here at the Dutch Legal Tech Meetup (the overall community has more than 800 members) – yesterday I spoke at a special student focused session! Thanks to Jelle Van Veenen Jeroen Zweers for serving as my hosts.