Machine Learning Explained (via Google’s Nat + Lo)

Pretty useful summary which is something we try to teach our students in our Legal Analytics Course (which could really be called Machine Learning for Lawyers). BTW – For those of you who emailed us, we promise to fill out the balance of the set of free, online Legal Analytics course materials in the coming months.

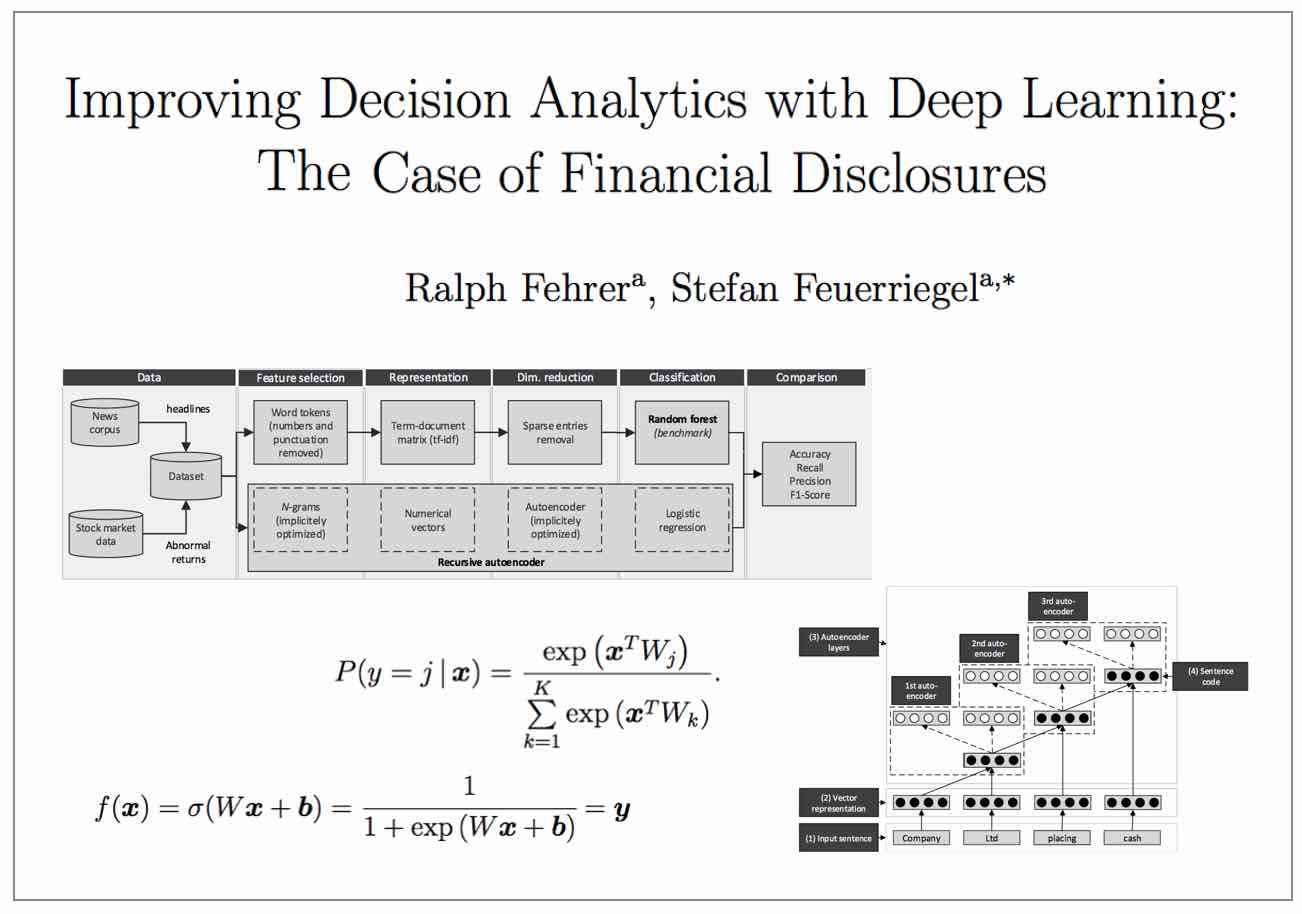

Econometrics (hereinafter Causal Inference) versus Machine Learning

Perhaps some hyperbolic language in here but the basic idea is still intact … for law+economics / empirical legal studies – the causal inference versus machine learning point is expressed in detail in this paper called “Quantitative Legal Prediction.” Mike Bommarito and I have made this point in these slides, these slides, these slides, etc. Mike and I also make this point on Day 1 of our Legal Analytics Class (which really could be called “machine learning for lawyers”).

Perhaps some hyperbolic language in here but the basic idea is still intact … for law+economics / empirical legal studies – the causal inference versus machine learning point is expressed in detail in this paper called “Quantitative Legal Prediction.” Mike Bommarito and I have made this point in these slides, these slides, these slides, etc. Mike and I also make this point on Day 1 of our Legal Analytics Class (which really could be called “machine learning for lawyers”).

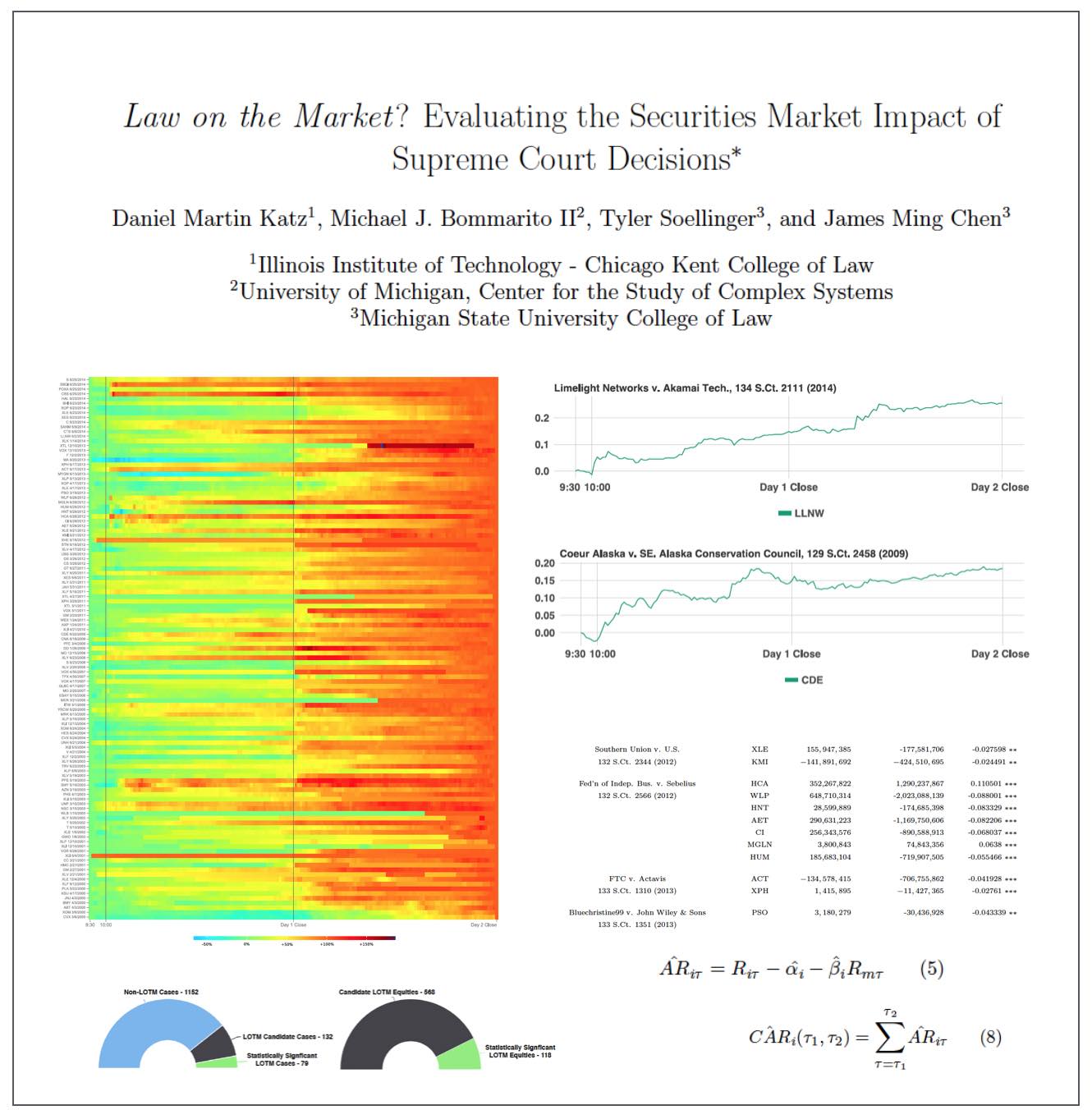

Law on the Market? Evaluating the Securities Market Impact Of Supreme Court Decisions (Katz, Bommarito, Soellinger & Chen)

ABSTRACT: Do judicial decisions affect the securities markets in discernible and perhaps predictable ways? In other words, is there “law on the market” (LOTM)? This is a question that has been raised by commentators, but answered by very few in a systematic and financially rigorous manner. Using intraday data and a multiday event window, this large scale event study seeks to determine the existence, frequency and magnitude of equity market impacts flowing from Supreme Court decisions.

We demonstrate that, while certainly not present in every case, “law on the market” events are fairly common. Across all cases decided by the Supreme Court of the United States between the 1999-2013 terms, we identify 79 cases where the share price of one or more publicly traded company moved in direct response to a Supreme Court decision. In the aggregate, over fifteen years, Supreme Court decisions were responsible for more than 140 billion dollars in absolute changes in wealth. Our analysis not only contributes to our understanding of the political economy of judicial decision making, but also links to the broader set of research exploring the performance in financial markets using event study methods.

We conclude by exploring the informational efficiency of law as a market by highlighting the speed at which information from Supreme Court decisions is assimilated by the market. Relatively speaking, LOTM events have historically exhibited slow rates of information incorporation for affected securities. This implies a market ripe for arbitrage where an event-based trading strategy could be successful.

Available on SSRN and arXiv

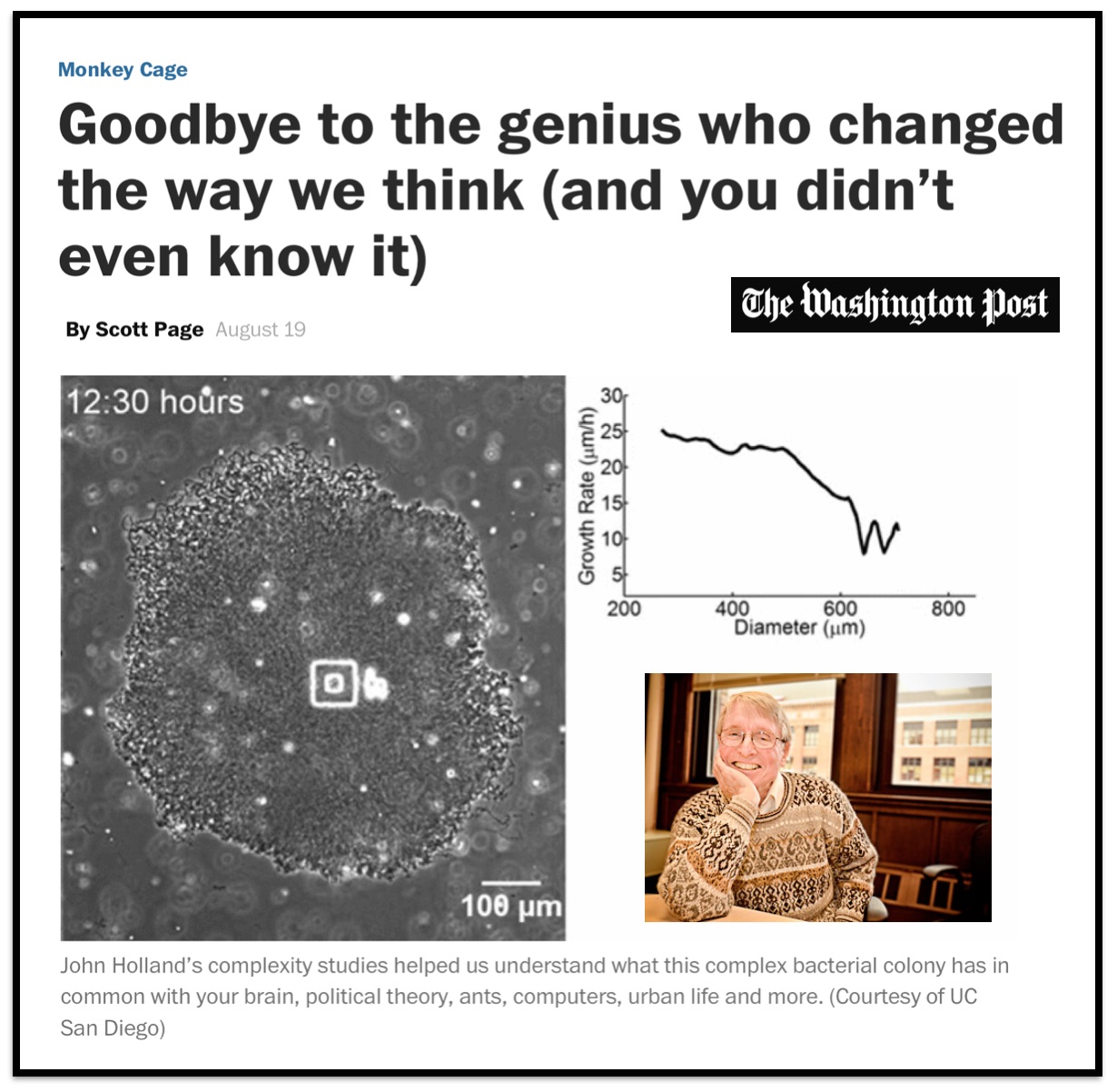

John Holland, Computer Scientist, Psychologist, and Complexity Scientist (1929-2015)

Mike and I had the great pleasure of spending several years at the University of Michigan Center for the Study of Complex Systems where John Holland spent a fair amount of his time. He was a very giving person and of course – a true genius! Rest in peace.

Mike and I had the great pleasure of spending several years at the University of Michigan Center for the Study of Complex Systems where John Holland spent a fair amount of his time. He was a very giving person and of course – a true genius! Rest in peace.

Your Lawyer May Soon Ask This AI-Powered App for Legal Help (via Wired)

“I thought back to that big problem lawyers face in their day-to-day work, and how it impacts regular people,” Ovbiagele tells WIRED. “I thought we should apply the capabilities of machine learning to tackle this problem and make things better for lawyers and for clients.”

“I thought back to that big problem lawyers face in their day-to-day work, and how it impacts regular people,” Ovbiagele tells WIRED. “I thought we should apply the capabilities of machine learning to tackle this problem and make things better for lawyers and for clients.”

“LegalRank can figure out which results get preferential results, whether that’s prioritizing a case that has more citations, knowing that a Supreme Court case should rank higher than a local decision, and other nuances.”

A subsidiary of (world’s largest) global law firm Dentons, NextLaw Labs, has signed ROSS Intelligence as its first portfolio company.

Full disclosure – I am a member of the advisory board of NextLaw Labs.