See Also – Five Years Until Legal Services Market Faces Endgame – Richard Susskind

Author: clsadmin

Judges in Jeopardy? – Actually – It is Lawyers in Jeopardy

While I really appreciate the spirit of this article, I have to say that the question posed by the author is not actually the critical one. As noted by Larry Ribstein in his post “Lawyers in Jeopardy” — the primary question raised by Watson and other forms of soft to medium artificial intelligence is their impact on the market for legal services. In thinking about this broader problem, I am haunted by the line from There Will be Blood – “I Drink Your Milkshake.” In this metaphor, technology is the straw and the legal information engineer is Daniel Day Lewis.

It is worth noting that although high-end offerings such as Watson represent a looming threat to a variety of professional services — one need not look to something as lofty as Watson to realize the future is likely to be turbulent. Law’s Information Revolution is already underway and it is a revolution in data and a revolution in software. Software is eating the world and the market for legal services has already been impacted. This is only the beginning. We are at the very cusp of a data driven revolution that will usher in new fields such as Quantitative Legal Prediction (which I have discussed here).

Pressure on Big Law will continue. Simply consider the extent to which large institutional clients are growing in their sophistication. These clients are developing the data-streams necessary to effectively challenge their legal bills. Whether this challenge is coming from corporate procurement departments, corporate law departments or with the aid of third parties — the times they are indeed a-changin’.

A variety of intermediary consulting firms and legal informatics companies have developed a robust business advising corporate clients how to find various arbitrage opportunities in the legal services market. One of the best examples is TyMetrix — who has recently leveraged more than $4 billion in legal spend data to help General Counsels and their corporate law departments drive down legal costs. Indeed, The Real Rate Report has made a huge splash (if you do know what I am talking about – I suggest you learn – because it is a pretty big deal).

How to Fix Our Math Education [Sol Garfunkel and David Mumford] [via NYT]

From the article … “Imagine replacing the sequence of algebra, geometry and calculus with a sequence of finance, data and basic engineering … In math, what we need is “quantitative literacy,” the ability to make quantitative connections whenever life requires (as when we are confronted with conflicting medical test results but need to decide whether to undergo a further procedure) and “mathematical modeling,” the ability to move practically between everyday problems and mathematical formulations (as when we decide whether it is better to buy or lease a new car)…. ” To read the rest of the article please click here.

Physicist Cuts Plane Boarding Time in Half [via CNet & Hacker News]

“… Steffen considered various methods, such as boarding people in blocks, at random, and in window seats first. He set up a model using an algorithm based on the Monte Carlo optimization method used in statistics and mathematics. He found that the most efficient boarding method is to board alternate rows at a time, beginning with the window seats on one side, then the other, minimizing aisle interference. The window seats are followed by alternate rows of middle seats, then aisle seats. He also found that boarding at random is faster that boarding by blocks.” Coverage over at C-Net

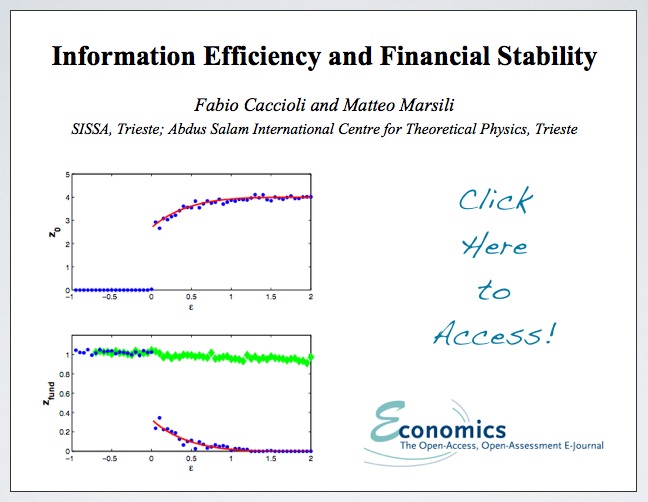

Information Efficiency and Financial Stability

From the abstract: “The authors study a simple model of an asset market with informed and non-informed agents. In the absence of non-informed agents, the market becomes information efficient when the number of traders with different private information is large enough. Upon introducing non-informed agents, the authors find that the latter contribute significantly to the trading activity if and only if the market is (nearly) information efficient. This suggests that information efficiency might be a necessary condition for bubble phenomena—induced by the behavior of non-informed traders—or conversely that throwing some sands in the gears of financial markets may curb the occurrence of bubbles.” [ HT: Paul Kedrosky ]

Introduction to Artificial Intelligence [ CS 221 – Free Online Course from Stanford University ]

“A bold experiment in distributed education, “Introduction to Artificial Intelligence” will be offered free and online to students worldwide during the fall of 2011. The course will include feedback on progress and a statement of accomplishment. Taught by Sebastian Thrun and Peter Norvig, the curriculum draws from that used in Stanford’s introductory Artificial Intelligence course. The instructors will offer similar materials, assignments, and exams.

Artificial Intelligence is the science of making computer software that reasons about the world around it. Humanoid robots, Google Goggles, self-driving cars, even software that suggests music you might like to hear are all examples of AI. In this class, you will learn how to create this software from two of the leaders in the field. Class begins October 10.” Check out the syllabus here. Although I have previously highlighted Academic Earth – I am a little late on this New York Times coverage available here. See also Andrew Ng’s class on Machine Learning (which is also available right now on Academic Earth).