Tag: tax

Bommarito, Katz & Isaacs-See –> Virginia Tax Review [ Online Supplement and Datasets ]

Our paper An Empirical Survey of the Population of United States Tax Court Written Decisions was recently published in the Virginia Tax Review. We have just placed supplementary materials online (click here or above to access).

Simply put, our paper is a “dataset paper.” While common in the social and physical sciences, there are far fewer (actually borderline zero) “dataset papers” in legal studies.

In our estimation, the goals of a “dataset paper” are three fold:

- (1) Introduce the data collection process with specific emphasis upon why the collection method was able to identify the targeted population

- (2) Highlight some questions that might be considered using this and other datasets

- (3) Make the data set available to various applied scholars who might like to use it

As subfields such as empirical legal studies mature (and in turn legal studies starts to look more like other scientific disciplines) it would be reasonable to expect to see additional papers of this variety. With the publication of the online supplement, we believe our paper has achieved each of these goals. Whether our efforts prove useful for others — well — only time will tell!

Death and Taxes 2010 — Using the Zoomorama Interface

Death and Taxes is an infographic classic created by Jess Bachman. The new version for 2010 is now available. Place the cursor over the graphic and wait for the {+,-} to show up. Then, zoom in read any part of the poster. Click and hold to move side to side. For more information or to order a poster … click through to Wall Stats. It is worth the click through as Wall Stats features a fully searchable legend which will autozoom on major executive agencies.

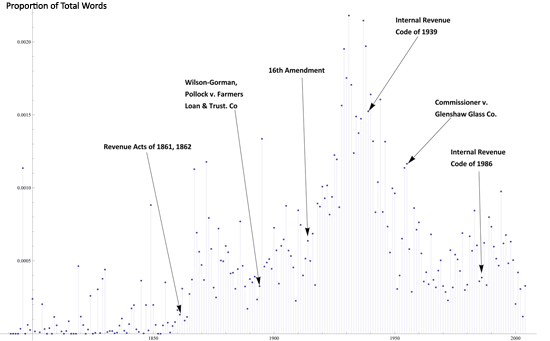

Tax Day! A First-Order History of the Supreme Court and Tax

Click to view the full image.

In honor of Tax Day, we’ve produced a simple time series representation of the Supreme Court and tax. The above plot shows the how often the word “tax” occurs in the cases of the Supreme Court, for each year – that is, what proportion of all words in every case in a given year are the word “tax.” The data underneath includes non-procedural cases from 1790 to 2004. The arrows highlight important legislation and cases for income tax as well.

Make sure to click through the image to view the full size.

Happy Tax Day!

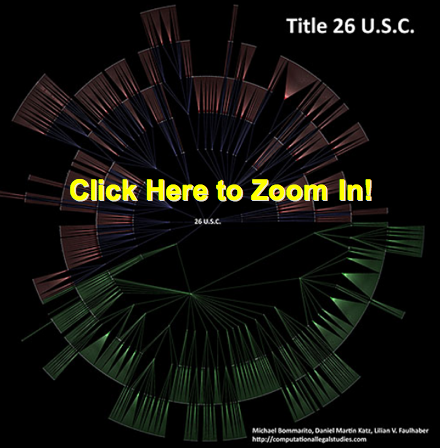

Visualizing 26 U.S.C ___ : At the “Section Depth”

Title 26 of the United States Code is likely on the mind of many as we move toward April 15th. As a part of a project with Lilian V. Faulhaber (Climenko Fellow from HLS), we have become interested in the architecture of 26 U.S.C. ___.

As we define it, a “section depth” representation for 26 U.S.C. 501(c)(3) represents a traversal to the level of Sec. 501. While a “full depth” representation would include a mapping beyond Sec. 501 to its (c) and (3) subcomponents. In our previous post highlighting 11 U.S.C. __ (the Bankruptcy Code), we presented a traversable “full depth” representation for its structure.

Considering all 50 titles of the United States Code, 26 U.S.C. __ is among the largest of the titles in its architectural size and depth. In fact, given its size, it is not possible for us to render for public consumption, a labeled, “full depth” and zoomable representation for all of 26 U.S.C. ___.

Above we provide a “section depth” representation for 26 U.S.C __ where the terminal nodes are sections such Sec. 1031. You will notice that this section depth representation is roughly the size of the full depth representation we provide for 11 U.S.C. ___. We have colored in Green the primary Income Tax Sections under 26. The documentation is similar to that for 11 U.S.C. ___ thus please refer to this post for additional information. However, for traversal purposes, it is important to remember to start in the middle at the “26 U.S.C.” and follow the branch of the graph out to a leaf node.

We believe the comparative consideration of the architecture for these titles offers a rough first cut on questions of code magnitude and complexity. Although it is a first order approximation and we do believe layering in the relevant administrative regulations and jurisprudence to these sections would represent an improvement on the question, it still bears asking whether it would drastically alter the macro state of affairs. That is an empirical question and only time will tell.