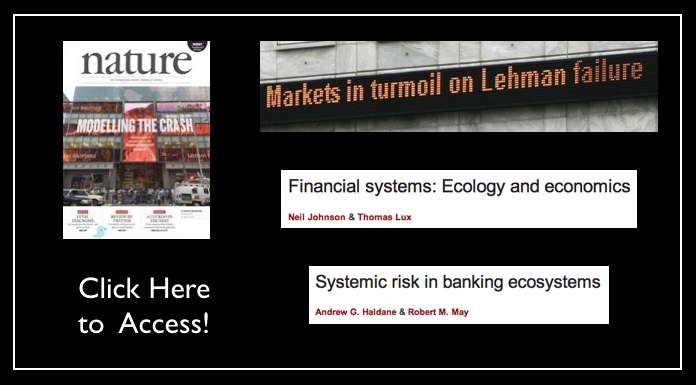

This week’s issue of Nature offers two brief but meaningful articles on the financial crisis. Here are the abstracts:

Financial Systems: Ecology and Economics (By Neil Johnson & Thomas Lux): “In the run-up to the recent financial crisis, an increasingly elaborate set of financial instruments emerged, intended to optimize returns to individual institutions with seemingly minimal risk. Essentially no attention was given to their possible effects on the stability of the system as a whole. Drawing analogies with the dynamics of ecological food webs and with networks within which infectious diseases spread, we explore the interplay between complexity and stability in deliberately simplified models of financial networks. We suggest some policy lessons that can be drawn from such models, with the explicit aim of minimizing systemic risk.”

Systemic Risk in Banking Ecosystems (By Andrew G. Haldane & Robert M. May): “In the run-up to the recent financial crisis, an increasingly elaborate set of financial instruments emerged, intended to optimize returns to individual institutions with seemingly minimal risk. Essentially no attention was given to their possible effects on the stability of the system as a whole. Drawing analogies with the dynamics of ecological food webs and with networks within which infectious diseases spread, we explore the interplay between complexity and stability in deliberately simplified models of financial networks. We suggest some policy lessons that can be drawn from such models, with the explicit aim of minimizing systemic risk.”

Dear Sir

You have posted identical abstracts/excerpts for what are supposed to be two different articles.

Yours Sincerely

It looks like abstracts for the first and second articles are the same (some problem during posting?)