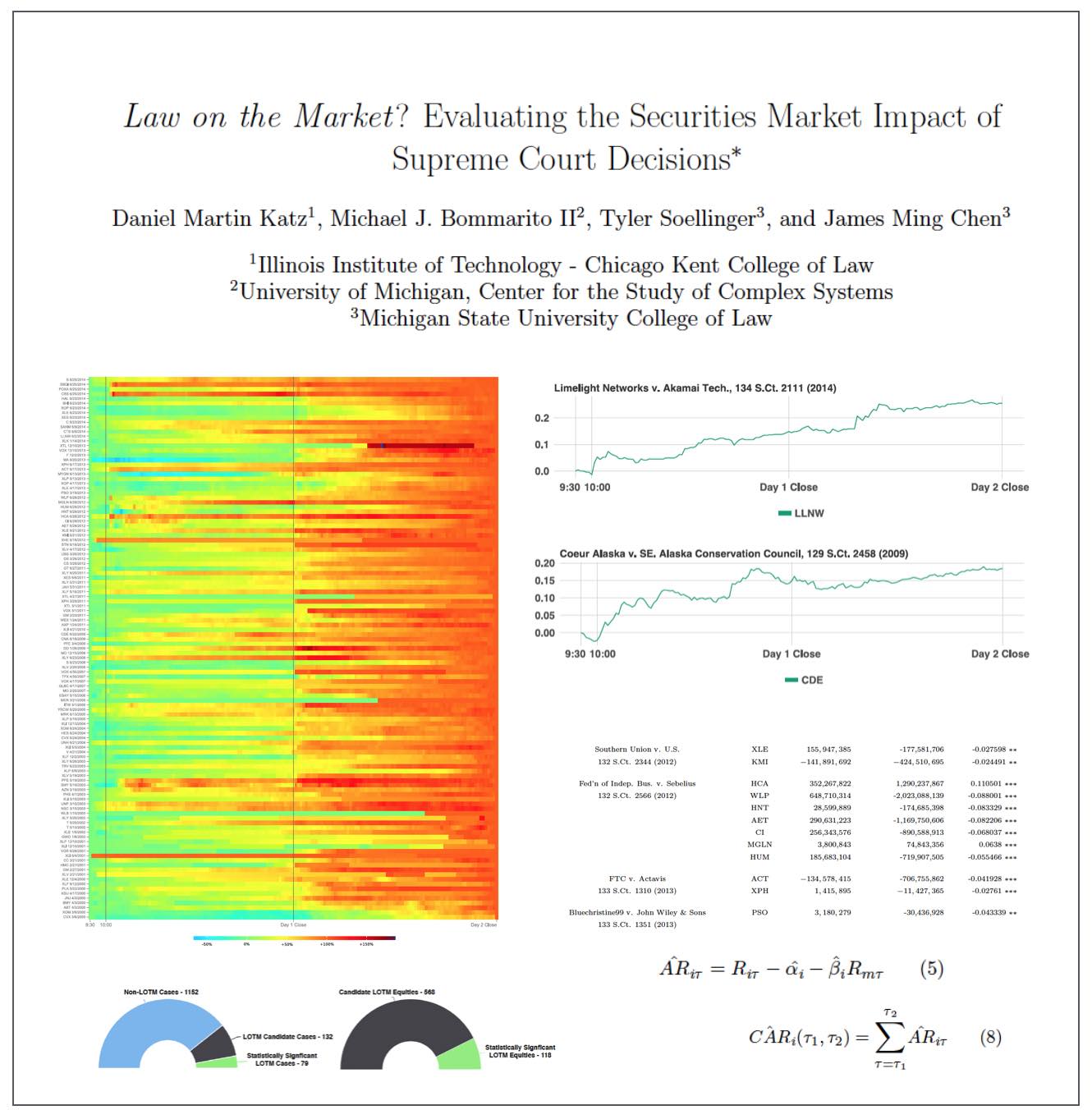

ABSTRACT: Do judicial decisions affect the securities markets in discernible and perhaps predictable ways? In other words, is there “law on the market” (LOTM)? This is a question that has been raised by commentators, but answered by very few in a systematic and financially rigorous manner. Using intraday data and a multiday event window, this large scale event study seeks to determine the existence, frequency and magnitude of equity market impacts flowing from Supreme Court decisions.

We demonstrate that, while certainly not present in every case, “law on the market” events are fairly common. Across all cases decided by the Supreme Court of the United States between the 1999-2013 terms, we identify 79 cases where the share price of one or more publicly traded company moved in direct response to a Supreme Court decision. In the aggregate, over fifteen years, Supreme Court decisions were responsible for more than 140 billion dollars in absolute changes in wealth. Our analysis not only contributes to our understanding of the political economy of judicial decision making, but also links to the broader set of research exploring the performance in financial markets using event study methods.

We conclude by exploring the informational efficiency of law as a market by highlighting the speed at which information from Supreme Court decisions is assimilated by the market. Relatively speaking, LOTM events have historically exhibited slow rates of information incorporation for affected securities. This implies a market ripe for arbitrage where an event-based trading strategy could be successful.

Available on SSRN and arXiv