As highlighted on Marginal Revolution, economist Herb Gintis has authored an Amazon.com review of the book “Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse” by Thomas E. Woods Jr. Suffice to say, the review is not flattering. Those interested in the direct attack on the book can read the full review here. Our particular interest in his review lies in the last third of the text where Professor Gintis highlights the genuine weaknesses of current macroeconomic theory. Below is the relevant text:

As highlighted on Marginal Revolution, economist Herb Gintis has authored an Amazon.com review of the book “Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse” by Thomas E. Woods Jr. Suffice to say, the review is not flattering. Those interested in the direct attack on the book can read the full review here. Our particular interest in his review lies in the last third of the text where Professor Gintis highlights the genuine weaknesses of current macroeconomic theory. Below is the relevant text:

“I am often asked why macroeconomic theory is in such an awful state. The answer is simple. The basic model of the market economy was laid out by Leon Walras in the 1870’s, and its equilibrium properties were well established by the mid-1960’s. However, no one has succeeded in establishing its dynamical properties out of equilibrium. But macroeconomic theory is about dynamics, not equilibrium, and hence macroeconomics has managed to subsist only by ignoring general equilibrium in favor of toy models with a few actors and a couple of goods. Macroeconomics exists today because we desperately need macro models for policy purposes, so we invent toy models with zero predictive value that allow us to tell reasonable policy stories, the cogency of which are based on historical experience, not theory.

I think it likely that macroeconomics will not become scientifically presentable until we realize that a market economy is a complex dynamic nonlinear system, and we start to use the techniques of complexity analysis to model it. I present my arguments in Herbert Gintis, “The Dynamics of General Equilibrium“, Economic Journal 117 (2007):1289-1309.

While we do not necessarily agree with every point made in his review, the general thrust of the above argument is directly in line with the thinking of many here at the Center for the Study of Complex Systems. Indeed, the rebuke offered above could be extended and applied to other work in Economics and Political Science. A significant part of the problem is that the analytical apparatus in question is simply not up to the complexity of the relevant problems. Most of the current approaches derive from an era when a CPU had a transistor count of less than 10k and memory was exceedingly expensive. It is not as though leading scholars of the day were completely unaware that most systems are far more intricate than a “few actors and a few goods.” However, tractability concerns created a strong incentive to develop models which could be solved analytically.

Moderately high-end machines now have transistor counts of greater than 2,000,000,000 and memory is incredibly cheap (see generally Moore’s Law). No need to impose fixed point equilibrium assumptions when there is no qualitative justification for eliminating the possibility that limit cycle attractors, strange attractors or some class of dynamics are, in fact, the genuine dynamics of the system. We have previously highlighted the press release “What Computer Science Can Teach Economics“ (and other social sciences). This is really important work. However, it is really only the beginning.

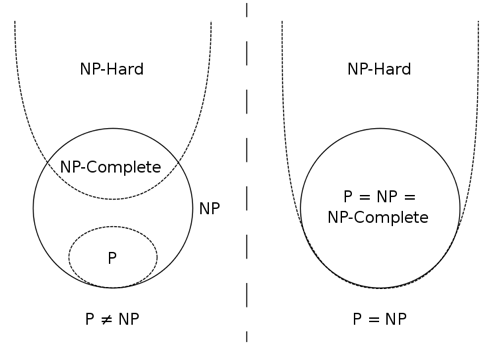

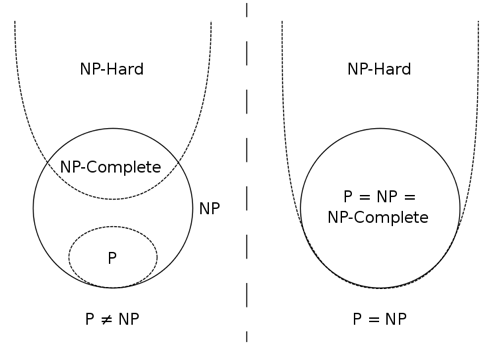

More realistic representations of these complex systems are possible, however, it requires scholars to consider jettisoning analytical approaches/solutions. When modeling complex adaptive systems far more granularity is possible but this requires a direct consideration of questions of computation and computational complexity. The use of a computational heuristic is really not that problematic and it can help sidestep truly hard problems (i.e. NP Complete and the like). The difficult question is how and under what conditions one should select among the available set of such heuristics.

More realistic representations of these complex systems are possible, however, it requires scholars to consider jettisoning analytical approaches/solutions. When modeling complex adaptive systems far more granularity is possible but this requires a direct consideration of questions of computation and computational complexity. The use of a computational heuristic is really not that problematic and it can help sidestep truly hard problems (i.e. NP Complete and the like). The difficult question is how and under what conditions one should select among the available set of such heuristics.

It is important to note, the dominant paradigm was itself a heuristic representation of agent behavior (and a useful one). While there are still some true believers, a declining number of serious scholars still assert that individuals are actually perfect rational maximizers. At best, this assumption is a useful guidepost for agent behavior and is one which can be subjected to revision by continued work in behavioral economics and neuroeconomics.

For those looking for a genuine intellectual arbitrage opportunity … the path is clear … devote your time to filling the space as this is a space with significant potential returns. The way forward is to remix traditional approaches with leading findings in neuroscience, psychology, institutional analysis and most importantly computer science … winner gets a call from Sweden in about t+25.

As highlighted on

As highlighted on