Tag: complex systems

Transportation in Contemporary Society: A Complex Systems Approach [Via MIT World]

.

Complex Systems: A Survey

From the abstract: “A complex system is a system composed of many interacting parts, often called agents, which displays collective behavior that does not follow trivially from the behaviors of the individual parts. Examples include condensed matter systems, ecosystems, stock markets and economies, biological evolution, and indeed the whole of human society. Substantial progress has been made in the quantitative understanding of complex systems, particularly since the 1980s, using a combination of basic theory, much of it derived from physics, and computer simulation. The subject is a broad one, drawing on techniques and ideas from a wide range of areas. Here I give a short survey and an annotated bibliography of resources for those interested in learning about complex systems.” [By Mark E.J. Newman – Submitted to Amer. J. Physics]

Complex systems is a relatively young subject area and one that is evolving rapidly, but there are nonetheless a number of general references, including books and reviews, that bring together relevant topics in a useful way. ” The paper then has recommended materials on major topics relevant to the study of complex systems including:

- Lattices and Networks

- Dynamical Systems (including Chaos & Fractals)

- Discrete Dynamics and Cellular Automata

- Scaling and Criticality

- Adaptation and Game Theory

- Information Theory

- Computational Complexity

- Agent-Based Modeling

“Classic examples of complex systems include condensed matter systems, ecosystems, the economy and financial markets, the brain, the immune system, granular materials, road traffic, insect colonies, flocking or schooling behavior in birds or fish, the Internet, and even entire human societies.”

Robert Trivers: Mathematical Approaches to Problems in Evolutionary Social Theory

Trivers is always very enlightening. Also, check out Part 2 and Part 3 … [HT to Fabio Rojas at OrgTheoryBlog]

Modeling the Financial Crisis [ From Nature ]

This week’s issue of Nature offers two brief but meaningful articles on the financial crisis. Here are the abstracts:

Financial Systems: Ecology and Economics (By Neil Johnson & Thomas Lux): “In the run-up to the recent financial crisis, an increasingly elaborate set of financial instruments emerged, intended to optimize returns to individual institutions with seemingly minimal risk. Essentially no attention was given to their possible effects on the stability of the system as a whole. Drawing analogies with the dynamics of ecological food webs and with networks within which infectious diseases spread, we explore the interplay between complexity and stability in deliberately simplified models of financial networks. We suggest some policy lessons that can be drawn from such models, with the explicit aim of minimizing systemic risk.”

Systemic Risk in Banking Ecosystems (By Andrew G. Haldane & Robert M. May): “In the run-up to the recent financial crisis, an increasingly elaborate set of financial instruments emerged, intended to optimize returns to individual institutions with seemingly minimal risk. Essentially no attention was given to their possible effects on the stability of the system as a whole. Drawing analogies with the dynamics of ecological food webs and with networks within which infectious diseases spread, we explore the interplay between complexity and stability in deliberately simplified models of financial networks. We suggest some policy lessons that can be drawn from such models, with the explicit aim of minimizing systemic risk.”

Riders on a Swarm — Might Mimicking the Behavior of Ants, Bees & Birds Be the Key to Artificial Intelligence?

This week’s issue of the Economist has an interesting article entitled Riders on a Swarm. Among other things, the article discusses how attempts to computationally model ant, bee and bird behavior have offered insight into major problems in artificial intelligence.

For those not familiar, the examples discussed within the article are classic models in the science of complex systems. For example, here is the Netlogo implementation of bird flocking. It will run in your browser but requires Java 4.1 or higher. If you decide to take a look — please click setup – then go to make the model run. Once inside the Netlogo GUI, you can explore how various parameter configurations impact the model’s outcomes.

One of the major insights of the bird flocking model is how random starting conditions and local behavioral rules can lead to the emergence of observed behavioral patterns that appear (at least on first glance) to be orchestrated by some sort of top down command structure.

This is, of course, not the case. The model is bottom up and not top down. Both the simplicity and the bottom up flavor of the model are apparent when you explore the model’s code. For those interested, I will take a second and plug the slides from my ICPSR class. In the class, I dedicated about an hour of class time to bird flocking model. Click here for the slides. In the slides, I walk through some of the important features of the code (discussion starts on slide 16).

Scott Page on Leveraging Diversity

Diversity is one the major topics of interest here at Michigan Center for the Study of Complex Systems. This includes diversity as experienced in physical as well as in social systems. On this topic, here is a lecture that one of my dissertation advisors, Scott Page gave earlier this year at the Darden School of Business at Virginia. This lecture is related to his book about the power of diversity entitled: The Difference: How The Power of Diversity Creates Better Groups, Firms, Schools, and Societies. Although I realize it is roughly a 90 minute talk, I believe that you will find that it is well worth the time!

Introduction to Computing for Complex Systems — ICPSR 2010 Slides for Self-Teaching Available Online!

This summer, I am teaching the Introduction to Computing for Complex Systems course at the ICPSR 2010 Program in Quantitative Methods. On the first day of class, I previously blogged about the course and thus if you are interested in additional details — feel free to consult the prior post.

This summer, I am teaching the Introduction to Computing for Complex Systems course at the ICPSR 2010 Program in Quantitative Methods. On the first day of class, I previously blogged about the course and thus if you are interested in additional details — feel free to consult the prior post.

For those interested in an introductory course that does not assume significant prior preparation, I did want to put up another post highlighting that all of course material (to date) is now freely available online. This includes course slides, model examples and assignments.

In this introductory course, I highlight several environments designed to explore the field of complex systems. These include Netlogo (agent based models and network models), Vensim (system dynamics / ecological modeling) and Pajek (empirical network analysis). Although, we do not work with more advanced languages within the course, those who need to conduct complex analysis are directed to alternatives such as R, Python, Java.

In the course slides, I offer a history of the science of complex systems and walk step-by-step through the process of model development and implementation. The slides and associated materials are designed to be a complete self-teaching environment where an individual who follows along carefully should be able to bring him or herself up to speed. More material will be added over the balance of the four-week session. So, please check back for more … including slides from our guest speakers!

ICPSR 2010 Summer Program — Introduction to Computing for the Study of Complex Systems

This summer I will be teaching a summer course entitled Introduction to Computing for the Study of Complex Systems at the ICPSR Summer Program in Quantitative Methods. For those not familiar, ICSPR has been offering summer classes in methods since 1963. The Summer Program current features dozens of courses including basic and advanced econometrics, bayesian statistics, game theory, complex systems, network analysis, quantitative analysis of crime, etc.

The Complex Systems Computing Module runs together with the Complex Systems lectures offered by Ken Kollman (Michigan), Scott E. Page (Michigan), P.J. Lamberson (MIT-Sloan) and Kate Anderson (Carnegie Mellon). Here is the syllabus for the lecture.

The first computing session is tonight from 6-8pm at the ICPSR Computer Lab. If you click here or click on the image above you will be taken to a dedicated page that will host the syllabus and course slides! Note: The slides and assignments will not be posted until the conclusion of each class.

Benoît Mandelbrot: Fractals and the Art of Roughness [ Ted 2010 ]

Those who know me are well aware of my obsession with fractals (see here). But why listen to me when you can here from the man himself — Benoît Mandelbrot!

Complex Models for Dynamic Time Evolving Landscapes –or– Herb Gintis Offers a Strong Rebuke of “Meltdown” by Thomas Woods

As highlighted on Marginal Revolution, economist Herb Gintis has authored an Amazon.com review of the book “Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse” by Thomas E. Woods Jr. Suffice to say, the review is not flattering. Those interested in the direct attack on the book can read the full review here. Our particular interest in his review lies in the last third of the text where Professor Gintis highlights the genuine weaknesses of current macroeconomic theory. Below is the relevant text:

As highlighted on Marginal Revolution, economist Herb Gintis has authored an Amazon.com review of the book “Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse” by Thomas E. Woods Jr. Suffice to say, the review is not flattering. Those interested in the direct attack on the book can read the full review here. Our particular interest in his review lies in the last third of the text where Professor Gintis highlights the genuine weaknesses of current macroeconomic theory. Below is the relevant text:

“I am often asked why macroeconomic theory is in such an awful state. The answer is simple. The basic model of the market economy was laid out by Leon Walras in the 1870’s, and its equilibrium properties were well established by the mid-1960’s. However, no one has succeeded in establishing its dynamical properties out of equilibrium. But macroeconomic theory is about dynamics, not equilibrium, and hence macroeconomics has managed to subsist only by ignoring general equilibrium in favor of toy models with a few actors and a couple of goods. Macroeconomics exists today because we desperately need macro models for policy purposes, so we invent toy models with zero predictive value that allow us to tell reasonable policy stories, the cogency of which are based on historical experience, not theory.

I think it likely that macroeconomics will not become scientifically presentable until we realize that a market economy is a complex dynamic nonlinear system, and we start to use the techniques of complexity analysis to model it. I present my arguments in Herbert Gintis, “The Dynamics of General Equilibrium“, Economic Journal 117 (2007):1289-1309.

While we do not necessarily agree with every point made in his review, the general thrust of the above argument is directly in line with the thinking of many here at the Center for the Study of Complex Systems. Indeed, the rebuke offered above could be extended and applied to other work in Economics and Political Science. A significant part of the problem is that the analytical apparatus in question is simply not up to the complexity of the relevant problems. Most of the current approaches derive from an era when a CPU had a transistor count of less than 10k and memory was exceedingly expensive. It is not as though leading scholars of the day were completely unaware that most systems are far more intricate than a “few actors and a few goods.” However, tractability concerns created a strong incentive to develop models which could be solved analytically.

Moderately high-end machines now have transistor counts of greater than 2,000,000,000 and memory is incredibly cheap (see generally Moore’s Law). No need to impose fixed point equilibrium assumptions when there is no qualitative justification for eliminating the possibility that limit cycle attractors, strange attractors or some class of dynamics are, in fact, the genuine dynamics of the system. We have previously highlighted the press release “What Computer Science Can Teach Economics“ (and other social sciences). This is really important work. However, it is really only the beginning.

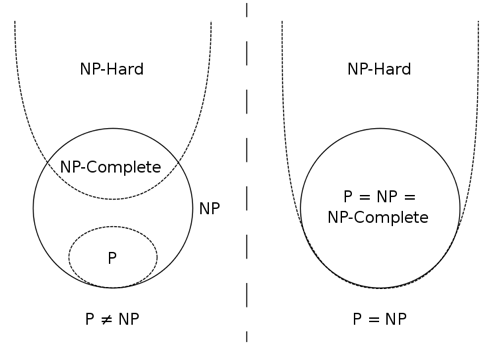

More realistic representations of these complex systems are possible, however, it requires scholars to consider jettisoning analytical approaches/solutions. When modeling complex adaptive systems far more granularity is possible but this requires a direct consideration of questions of computation and computational complexity. The use of a computational heuristic is really not that problematic and it can help sidestep truly hard problems (i.e. NP Complete and the like). The difficult question is how and under what conditions one should select among the available set of such heuristics.

More realistic representations of these complex systems are possible, however, it requires scholars to consider jettisoning analytical approaches/solutions. When modeling complex adaptive systems far more granularity is possible but this requires a direct consideration of questions of computation and computational complexity. The use of a computational heuristic is really not that problematic and it can help sidestep truly hard problems (i.e. NP Complete and the like). The difficult question is how and under what conditions one should select among the available set of such heuristics.

It is important to note, the dominant paradigm was itself a heuristic representation of agent behavior (and a useful one). While there are still some true believers, a declining number of serious scholars still assert that individuals are actually perfect rational maximizers. At best, this assumption is a useful guidepost for agent behavior and is one which can be subjected to revision by continued work in behavioral economics and neuroeconomics.

For those looking for a genuine intellectual arbitrage opportunity … the path is clear … devote your time to filling the space as this is a space with significant potential returns. The way forward is to remix traditional approaches with leading findings in neuroscience, psychology, institutional analysis and most importantly computer science … winner gets a call from Sweden in about t+25.