How to Fix Our Math Education [Sol Garfunkel and David Mumford] [via NYT]

From the article … “Imagine replacing the sequence of algebra, geometry and calculus with a sequence of finance, data and basic engineering … In math, what we need is “quantitative literacy,” the ability to make quantitative connections whenever life requires (as when we are confronted with conflicting medical test results but need to decide whether to undergo a further procedure) and “mathematical modeling,” the ability to move practically between everyday problems and mathematical formulations (as when we decide whether it is better to buy or lease a new car)…. ” To read the rest of the article please click here.

Physicist Cuts Plane Boarding Time in Half [via CNet & Hacker News]

“… Steffen considered various methods, such as boarding people in blocks, at random, and in window seats first. He set up a model using an algorithm based on the Monte Carlo optimization method used in statistics and mathematics. He found that the most efficient boarding method is to board alternate rows at a time, beginning with the window seats on one side, then the other, minimizing aisle interference. The window seats are followed by alternate rows of middle seats, then aisle seats. He also found that boarding at random is faster that boarding by blocks.” Coverage over at C-Net

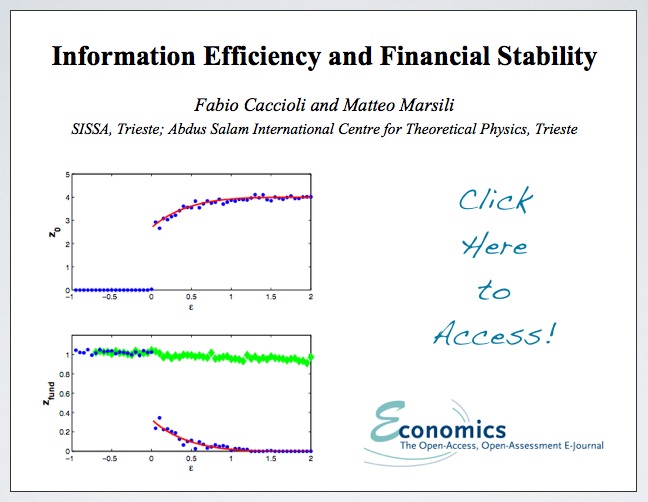

Information Efficiency and Financial Stability

From the abstract: “The authors study a simple model of an asset market with informed and non-informed agents. In the absence of non-informed agents, the market becomes information efficient when the number of traders with different private information is large enough. Upon introducing non-informed agents, the authors find that the latter contribute significantly to the trading activity if and only if the market is (nearly) information efficient. This suggests that information efficiency might be a necessary condition for bubble phenomena—induced by the behavior of non-informed traders—or conversely that throwing some sands in the gears of financial markets may curb the occurrence of bubbles.” [ HT: Paul Kedrosky ]

Introduction to Artificial Intelligence [ CS 221 – Free Online Course from Stanford University ]

“A bold experiment in distributed education, “Introduction to Artificial Intelligence” will be offered free and online to students worldwide during the fall of 2011. The course will include feedback on progress and a statement of accomplishment. Taught by Sebastian Thrun and Peter Norvig, the curriculum draws from that used in Stanford’s introductory Artificial Intelligence course. The instructors will offer similar materials, assignments, and exams.

Artificial Intelligence is the science of making computer software that reasons about the world around it. Humanoid robots, Google Goggles, self-driving cars, even software that suggests music you might like to hear are all examples of AI. In this class, you will learn how to create this software from two of the leaders in the field. Class begins October 10.” Check out the syllabus here. Although I have previously highlighted Academic Earth – I am a little late on this New York Times coverage available here. See also Andrew Ng’s class on Machine Learning (which is also available right now on Academic Earth).

Can the Middle Class Be Saved? [ via Atlantic Monthly ]

As I read this article, I ended up just inserting the phase “market for legal services” when the author said something like “the economy” or “the middle class.” In other words, the legal services industry has a number of the properties present in the overall economy. Indeed, there are two distinct trends at play – one is cyclical and the other is structural. The cyclical downturn in the market for legal services is related to broader economic conditions. Thus, the downturn in demand specifically associated with the broader business cycle will abate once broader economic conditions improve. The structural portion of the downturn is permanent and those jobs will not return.

Markets are not pleasant places – particularly when a mismatch develops between the skills / products that purchasers demand and the products / skills offered by sellers. Indeed, while there is an “equilibrium” solution – the question is on what time-scale it will be obtained. In the short to medium term, disruption is likely to be the name of the game. This market is in transition and as such this is a period that simultaneously offers both peril and possibility. Those who adapt to the conditions, who are entrepreneurial will do quite well. Others will have great difficulty. < Transition = peril for some ; Transition = Arbitrage opportunity for others >

As law’s information revolution continues to unfold, place your respective bets on folks who can blend skills such as data science, informatics, computer science / artificial intelligence, engineering, etc. with more traditional law pursuits. There is already some serious income inequality in the legal services market. There is good reason to believe this gap is likely to expand. Technology is going displace lawyers and the $$ for the displacing technologist will be directly proportionate the #’s of folks he/she displaces. In this vein, our industry is (unfortunately) just like every other industry.

It is important not to be fatalistic and to emphasize how individuals and institutions can respond. Students with a background in science and technology (rather than say the humanities, etc.) are likely to have a significant advantage in law’s information revolution. Institutions can help level this playing field by offering their students the requisite skills training necessary to be competitive within this new ordering. For example, at my new home – Michigan State University – College of Law – I will be teaching Quantitative Methods for Lawyers – a Winter 2012 course that will help students develop a number of relevant skills ( beyond those in the traditional statistics and the law course ). Indeed, although similar in some respects, I am positive this course will prove to be quite different ( and hopefully better? ) than any quantitative methods course currently offered at an American law school. Either way, my goal is help put the students who take the course on the path to becoming the skill blender that the market is likely looking to hire.

Here are the modules that I plan to offer in the Winter 2012 course:

- 1. Motivating the Need for Quantitative and Analytical Thinking

- 2. Research Design

- 3. Introduction to Probability & Basic Statistics

- 4. Introduction to Regression Analysis

- 5. Analogical Reasoning, Collaborative Filtering and the Science of Similarity

- 6. Research Design Revisited: Science (and Pseudo-Science) in the Courtroom

- 7. Regression Analysis and its use in the Law

- 8. Quantitative Legal Prediction

- 9. Network Analysis, Computational Linguistics, Clustering Algorithms (and the other Nuts and Bolts of E-Discovery), etc.

- 10. Mathematical and Computational Modeling

- 11. Legal Automation, Computation and the Law Practice of the Present (and Not So Distant Future)